Partner with us and we will take care of your client’s payroll needs.

Accountants

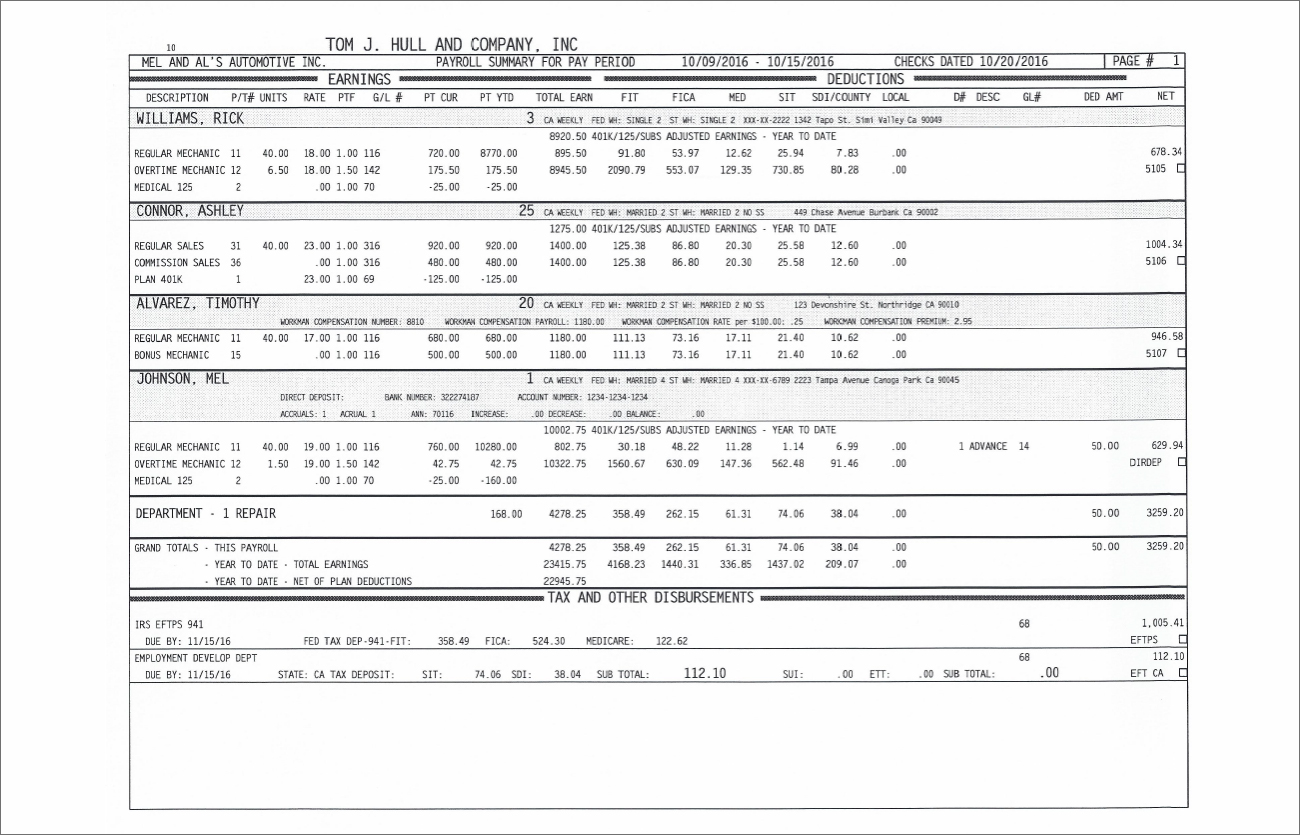

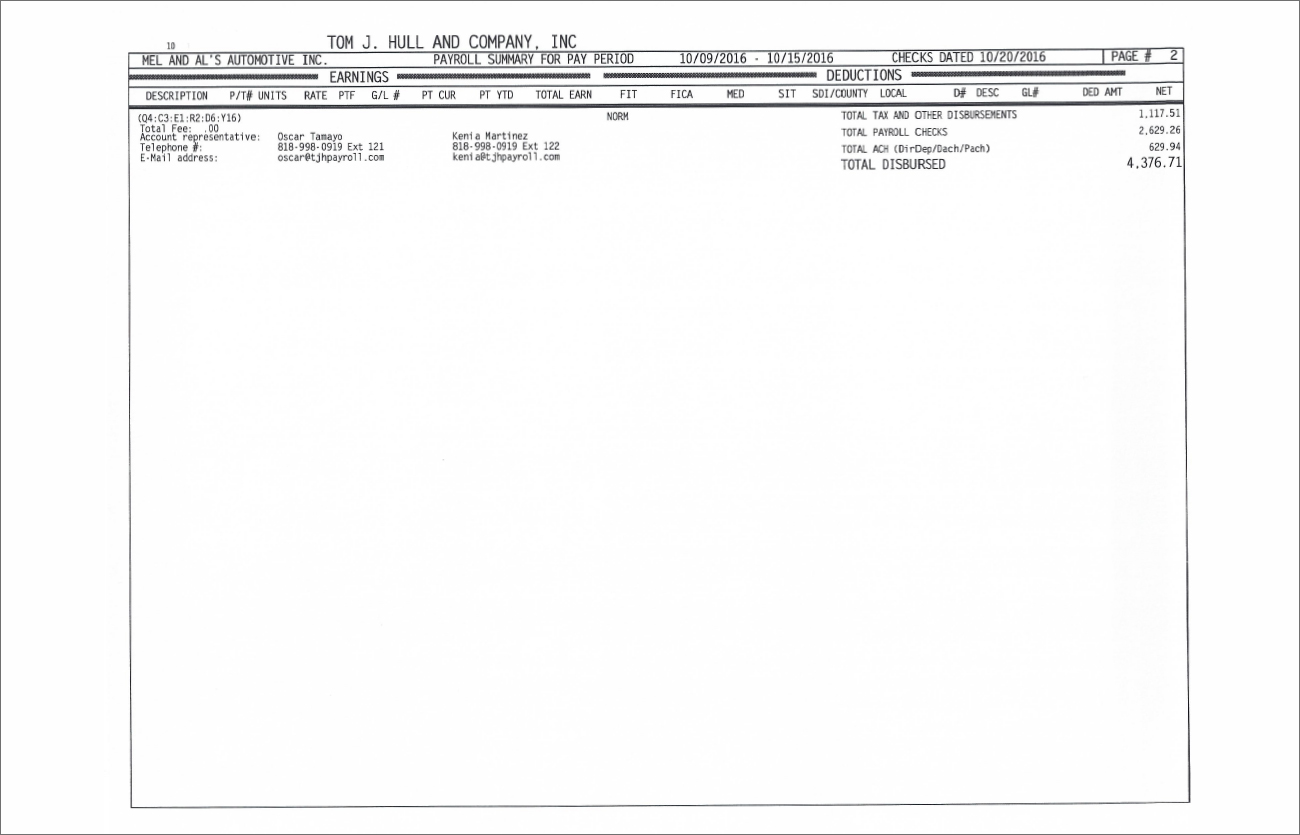

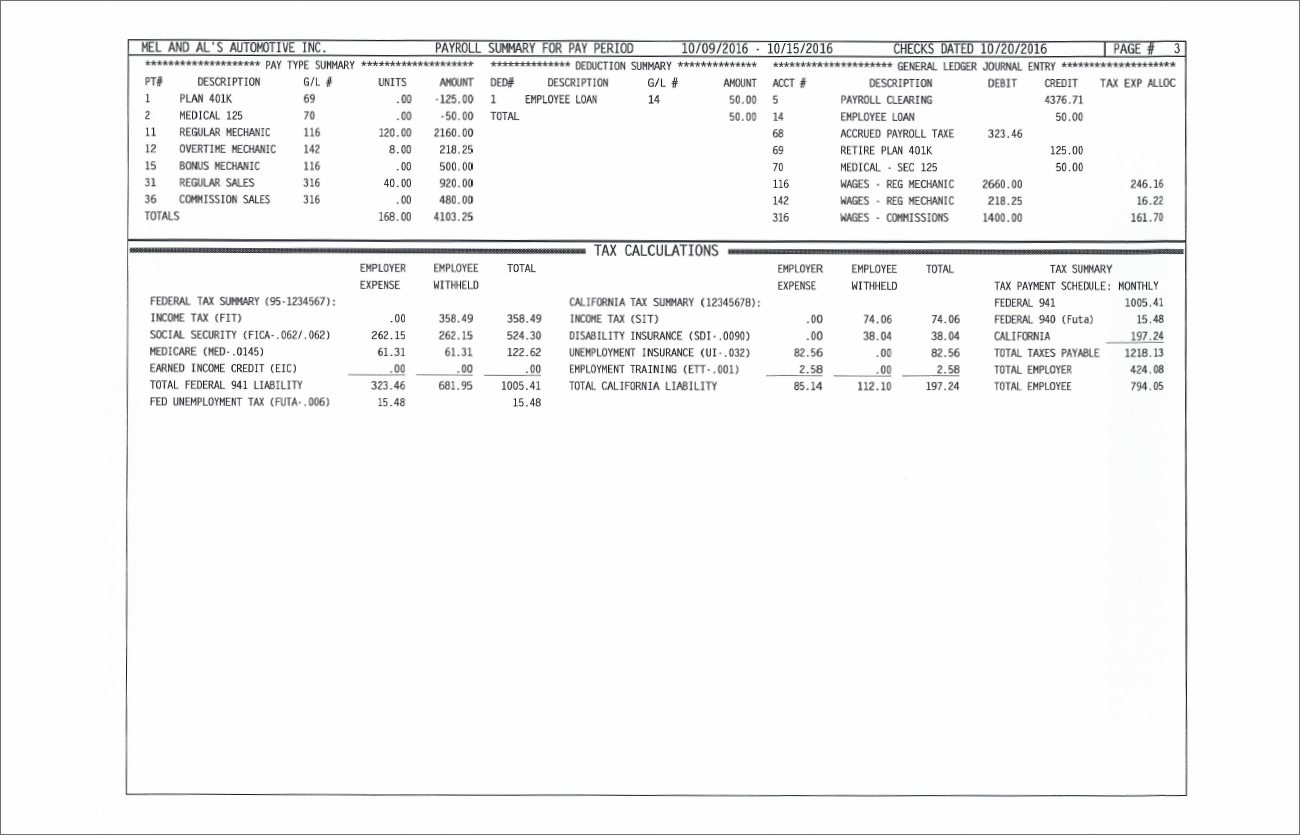

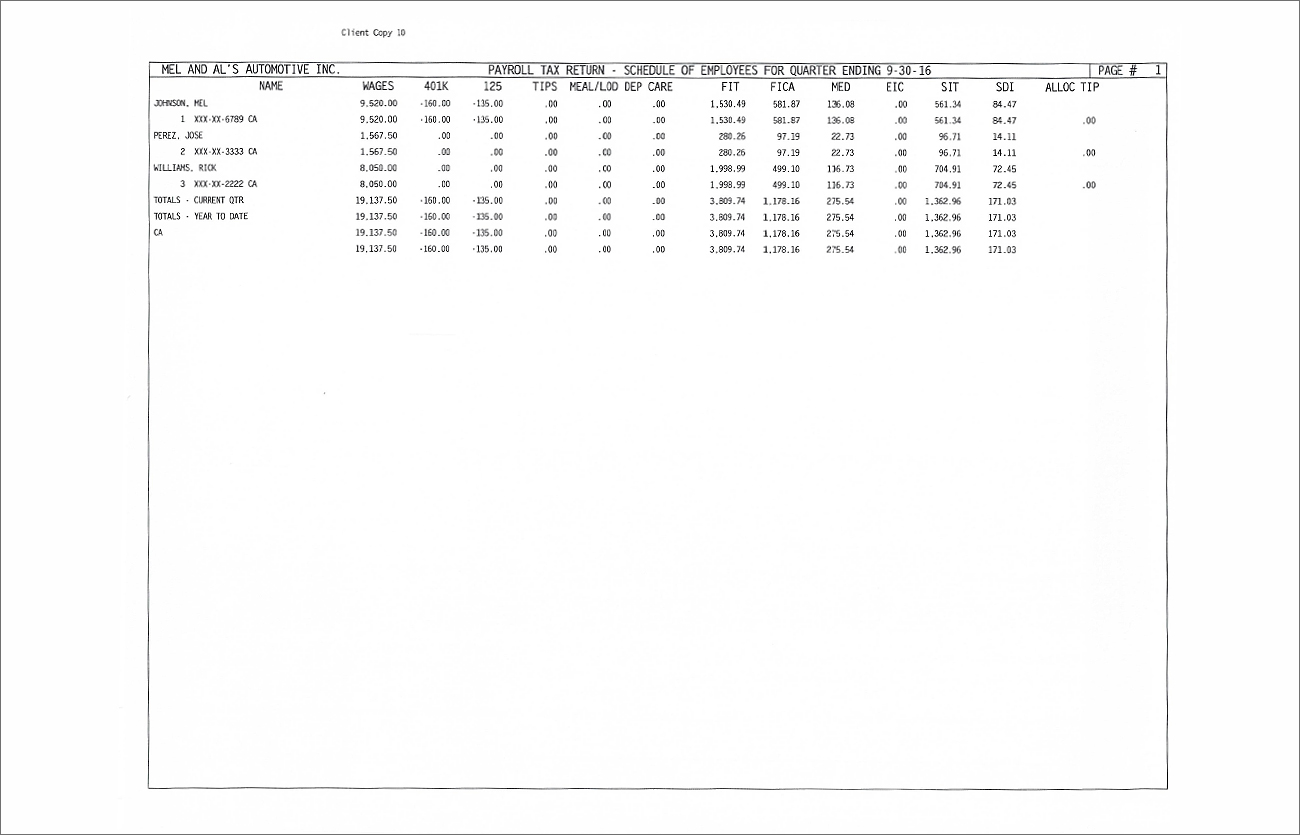

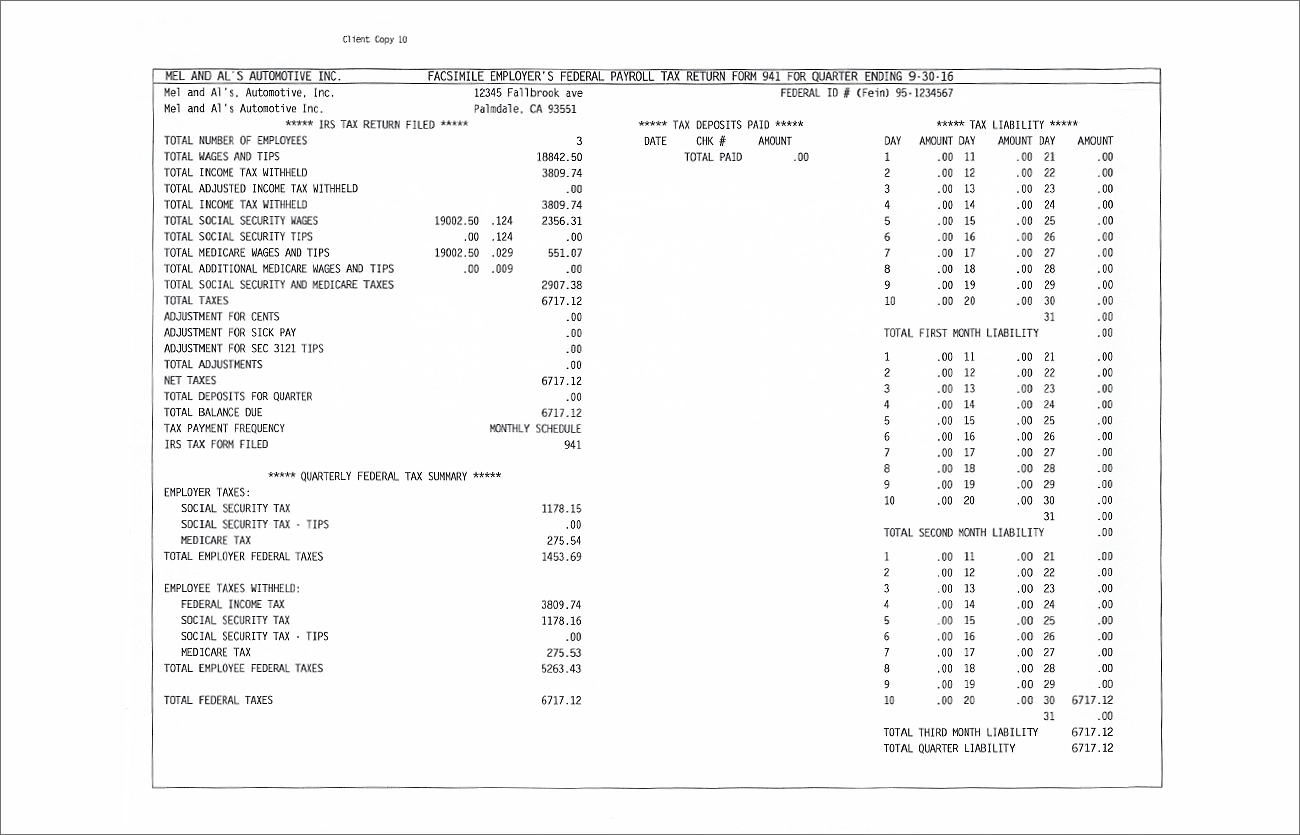

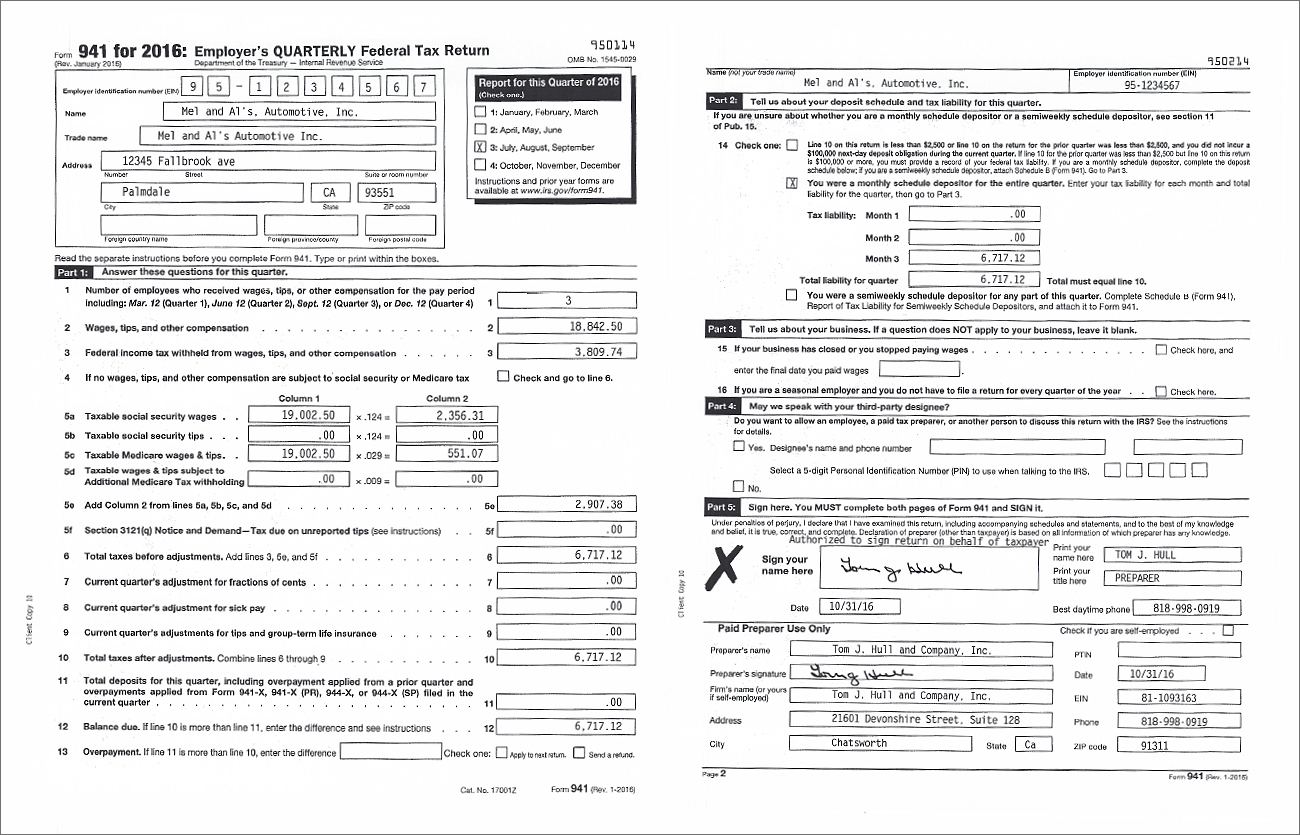

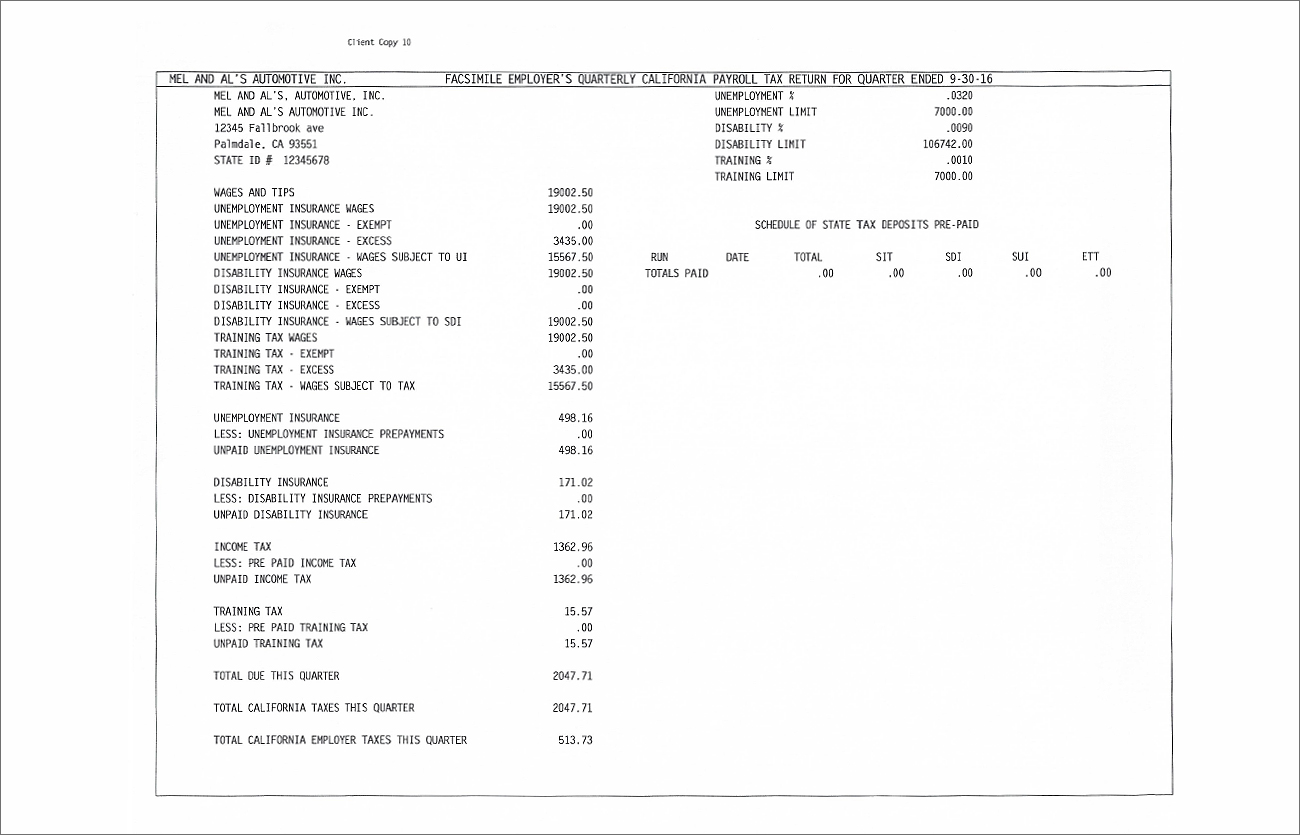

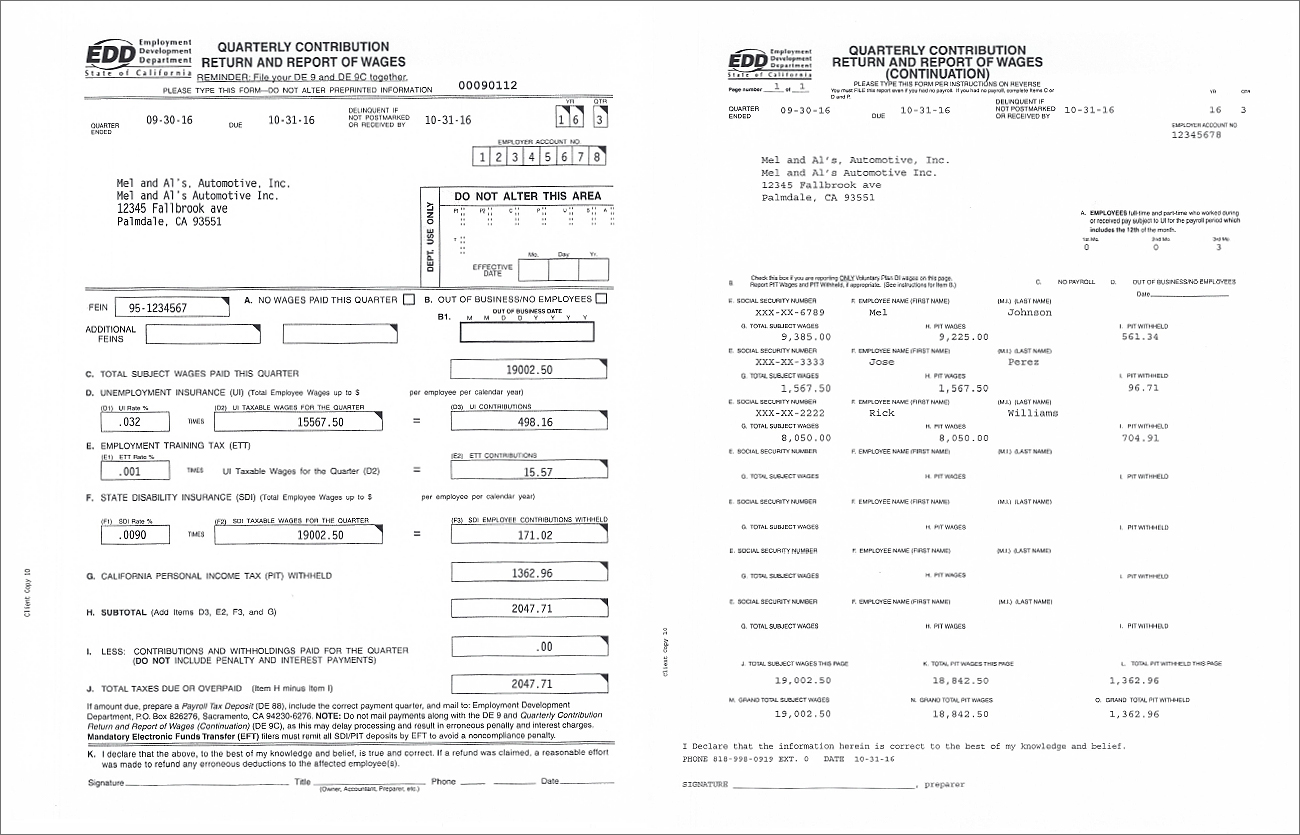

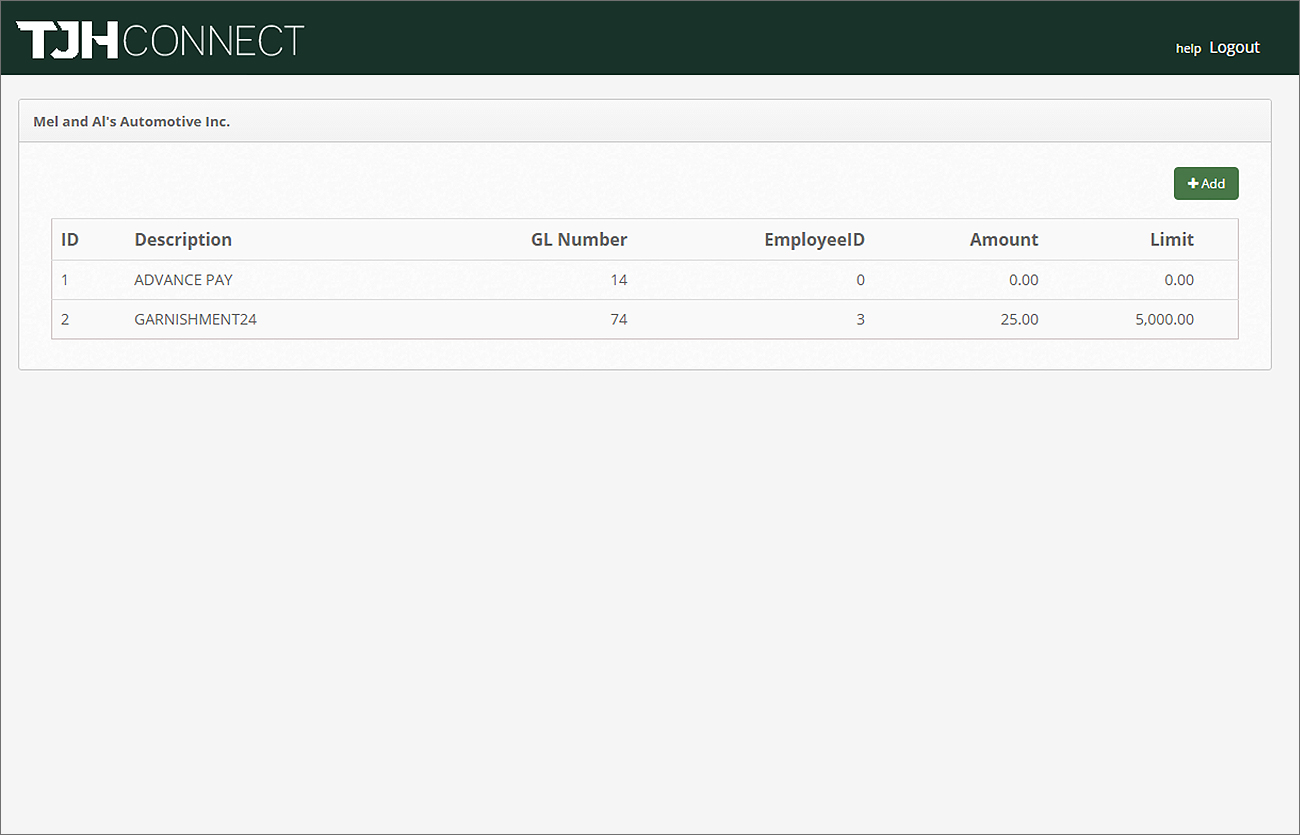

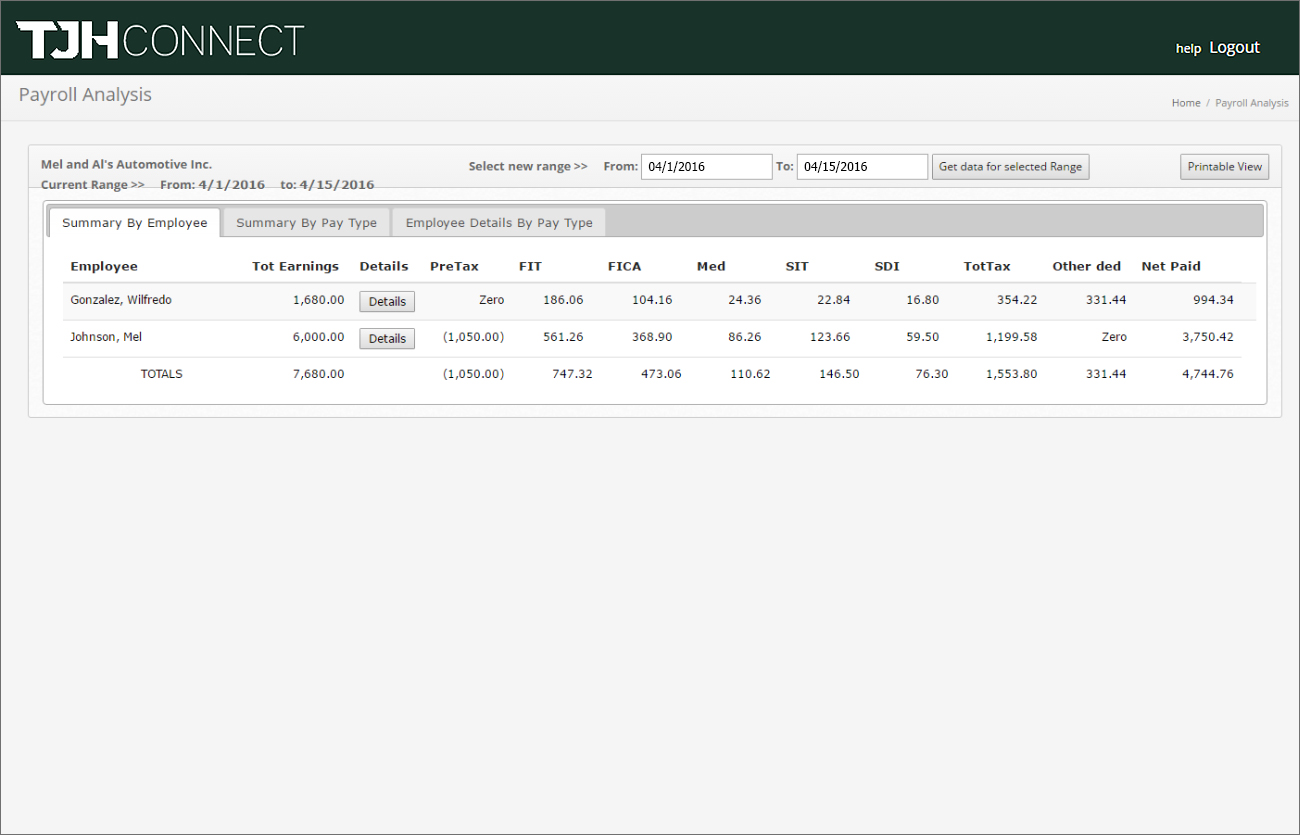

Our payroll system was designed by an accountant for accountants. Our Payroll Summary report comprises all pertinent information, including a general ledger summary referencing the client’s chart of accounts. We enjoy a close relationship with nearly all of our clients’ bookkeepers and accountants. As a smaller company, we can react quickly to your needs and instructions. Here is a sample of the Payroll Summary report we send via an instant email each time a payroll is processed. We send these emails to the client and optionally include you in the process. All the client’s information is available to the company’s accountant, including previous payroll summaries, quarterly tax filings and reports.

Fast, simple, and hassle-free payroll service that will save you time and money.

Starting at only $10.50 per payroll for up to 5 checks.

This Includes

1

Payroll Core

Service

2

Online Payroll

Management (TJH Connect)

3

Time and

Attendance Lite

4

Employee Portal

Sign Up or Request Details

Payroll Core Service

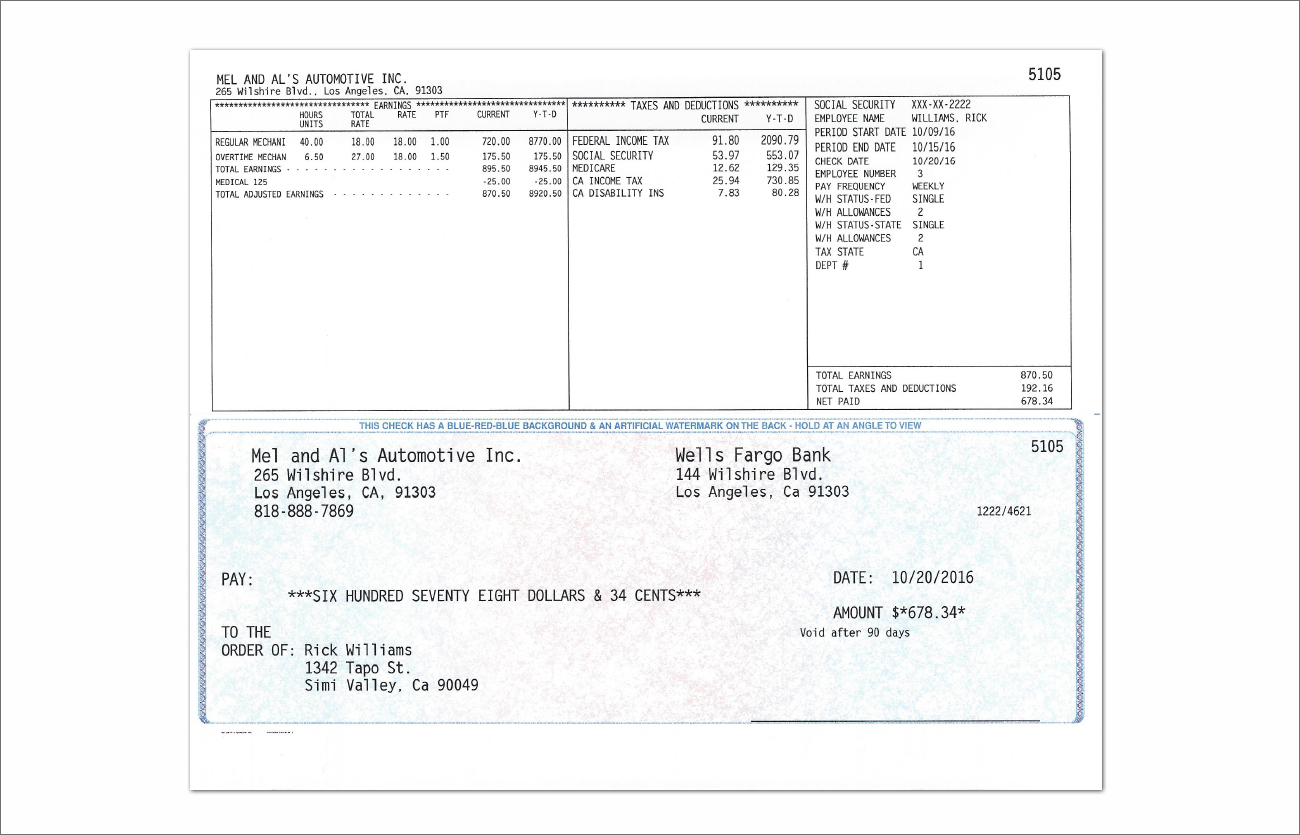

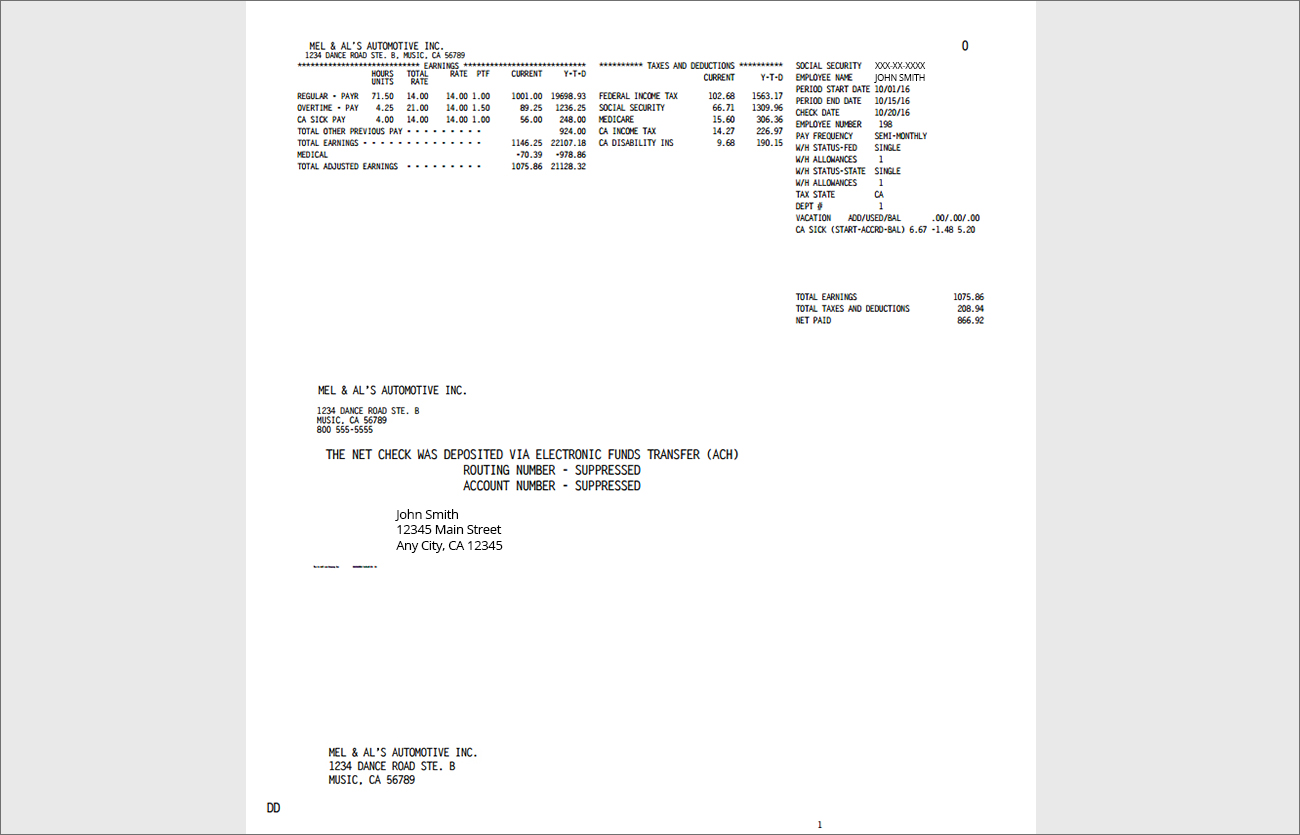

Payroll summary report provided after each payroll run. It includes information about your current payroll

period, year to date state and federal taxes. After each payroll processing, employers and employees

will be able to access the pay stub online.

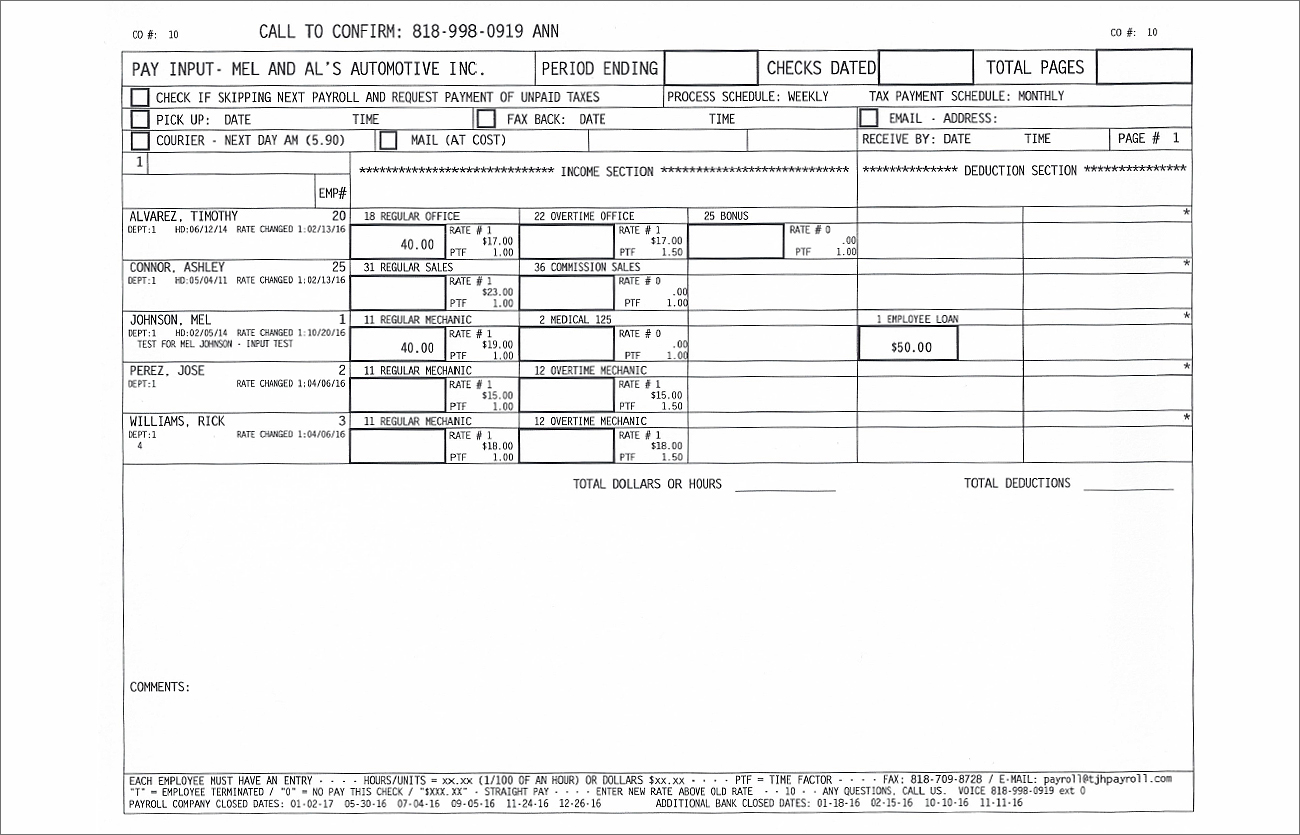

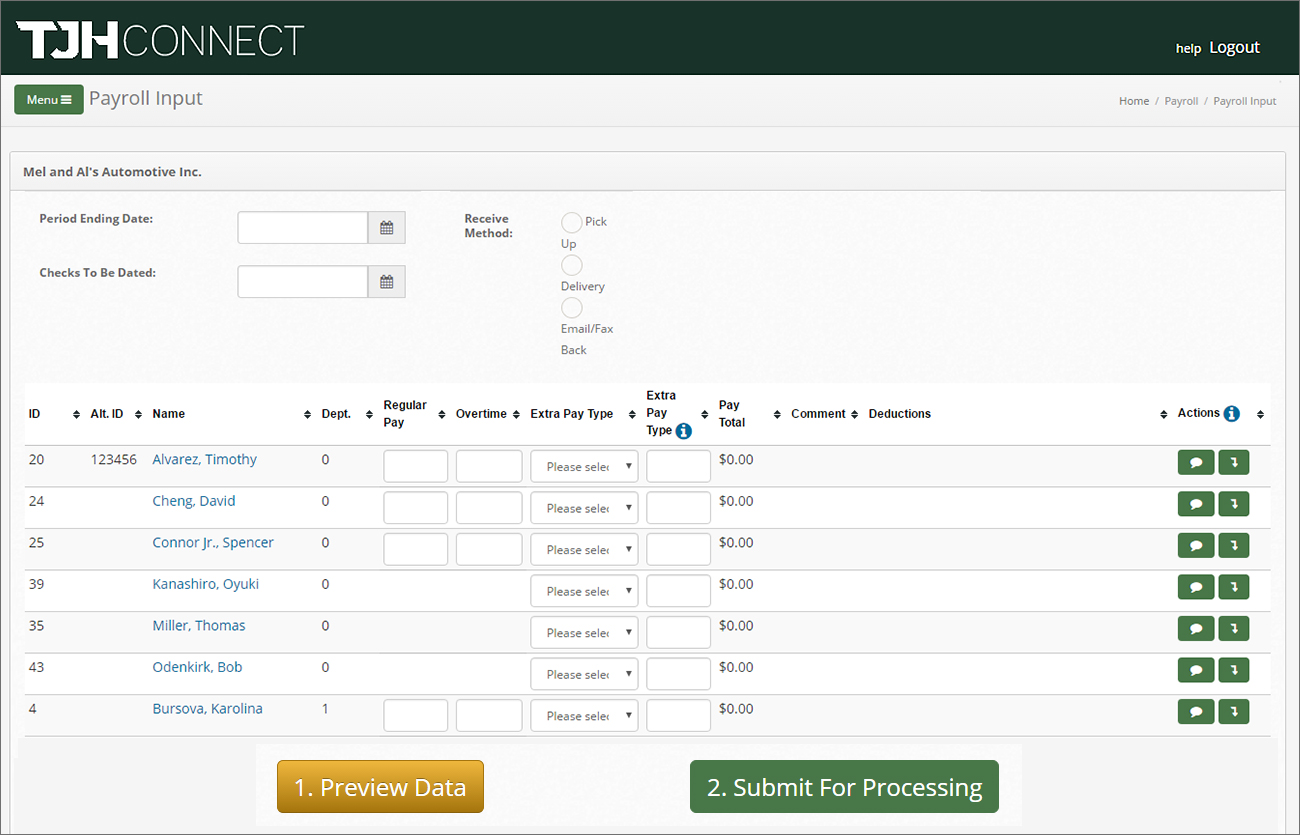

Input Methods

The input form is used to input pay data via fax and email attachment. It is still being used after many years because it is easy, secure and notes including employee social security numbers may be written on it then faxed to us at 818-709-8728. The cost for this is included in our basic fee schedule per check.

- Option to input online using TJH Connect

- Option to input via phone for an additional fee

- Option to input via fax or email

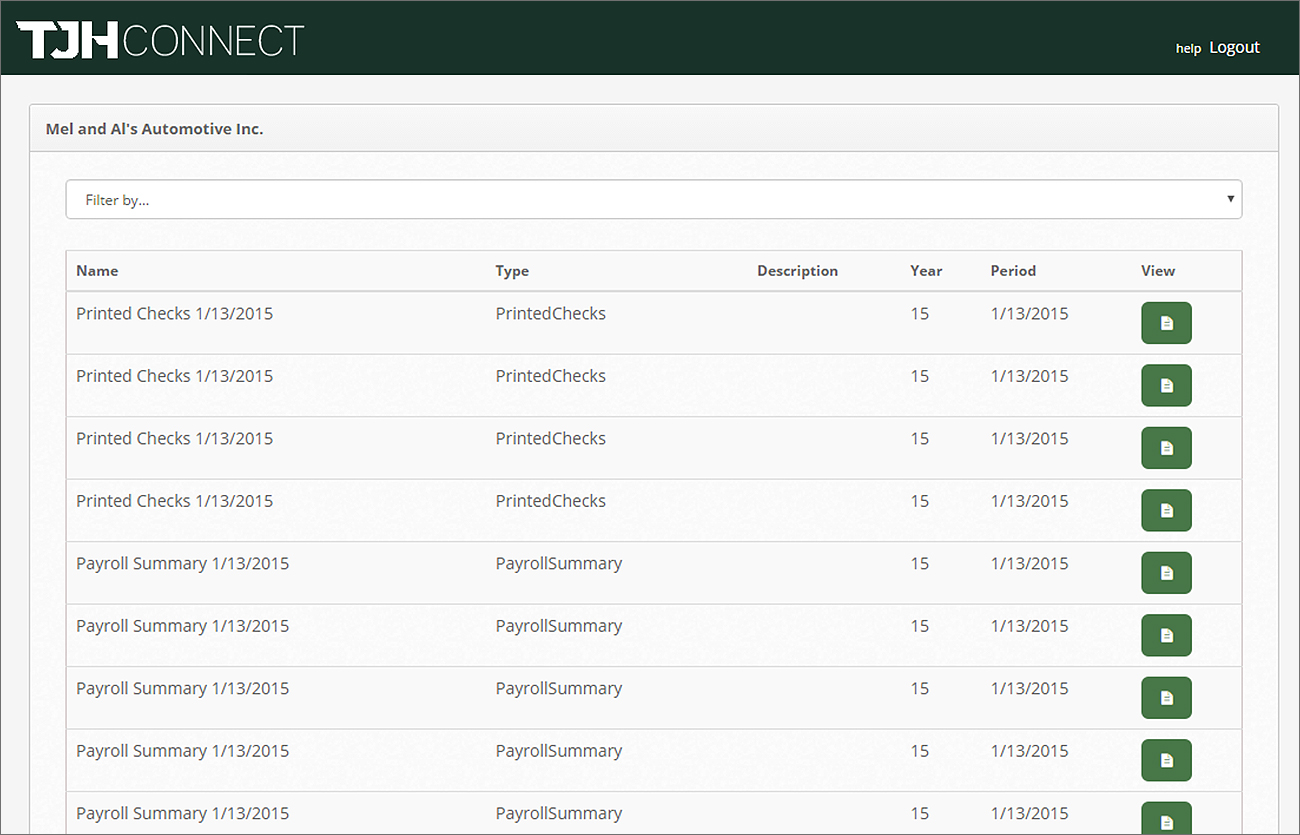

Our Famous Payroll Summary

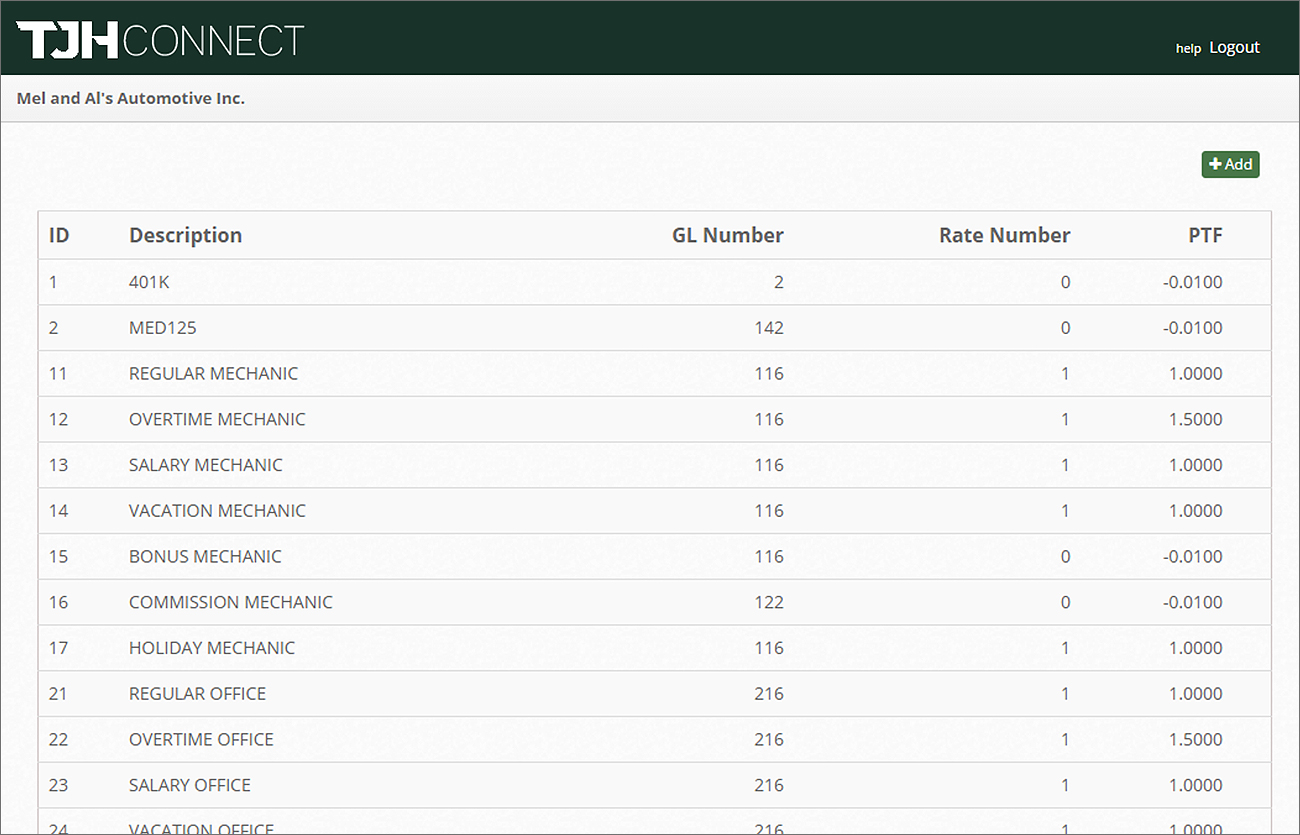

This is used whenever we disburse money or create a payroll entry. It may be emailed when the payroll notification is sent immediately upon completion of the payroll. A copy is usually mailed to the client with the pay checks. It provides a tax, pay type, deduction type and general ledger summaries. This is a key report to be saved by the client. A copy is available by email for the accountant if requested. Comprehensive Payroll Summary report ia available online or emailed as soon as payroll is complete.

- Employees Paycheck Details

- Taxes and Non Payroll Disbursements

- Total amount for Payroll

- Summary of Income, deductions, Tax

- GL Summary based on Client chart of Accounts, ready for posting

Payroll Completion

Payroll checks are available in two styles, both available for direct deposit. The first is our standard rainbow with prismatic printing for security and is included with our payroll service at no additional cost. The second is an ultra high security check with the same check stub, but pressure sealed for additional security and great for mailing. The cost is an additional 15 cents per check. Both checks have been approved by the state of California for conformity with existing labor laws regarding full disclosure to employees of their payroll check calculation, employer address, etc.

- Direct deposit cost: 35 cents – $2 per employee depending on volume)

- Can be paperless with an online login to see stubs and information

- Standard checks may come signed (signing included) or unsigned

- We can mail checks for the cost of the postage (pressure seal only)

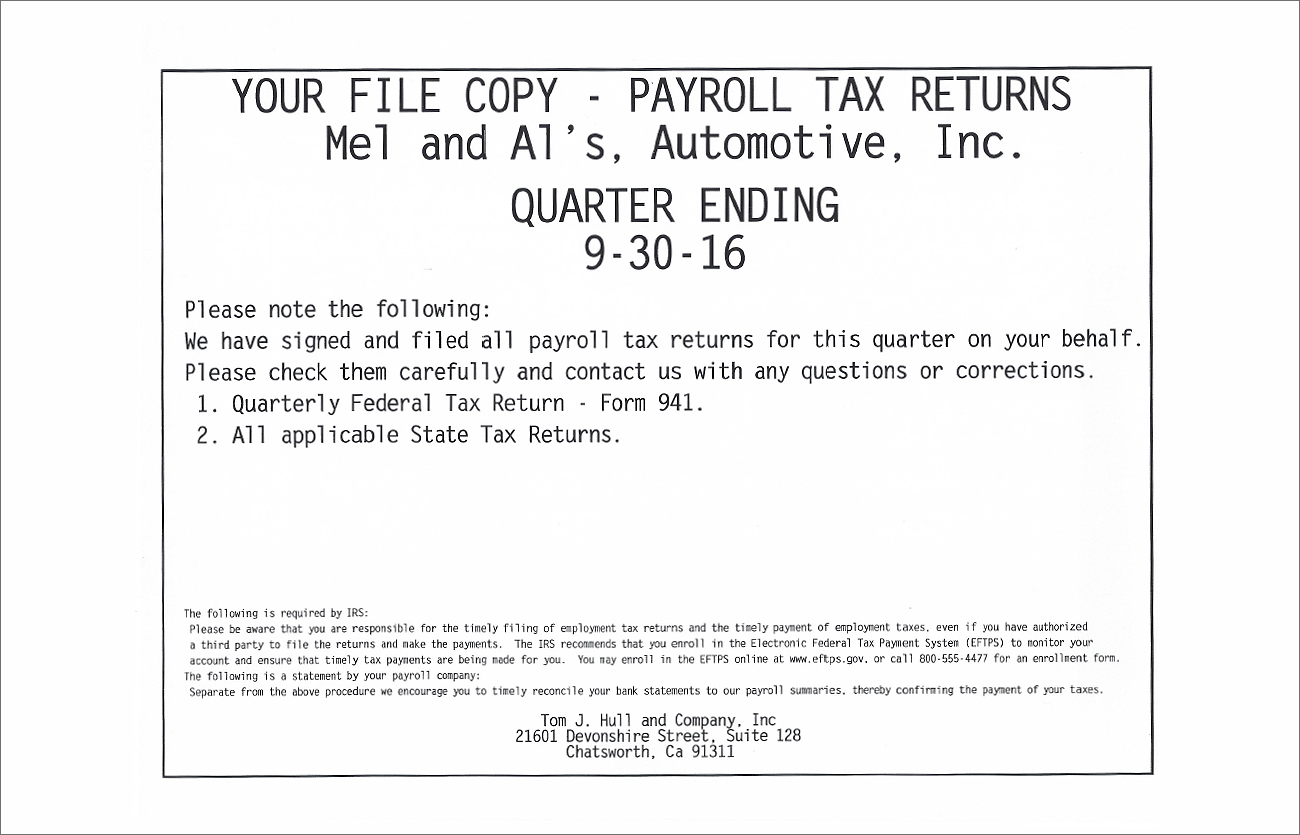

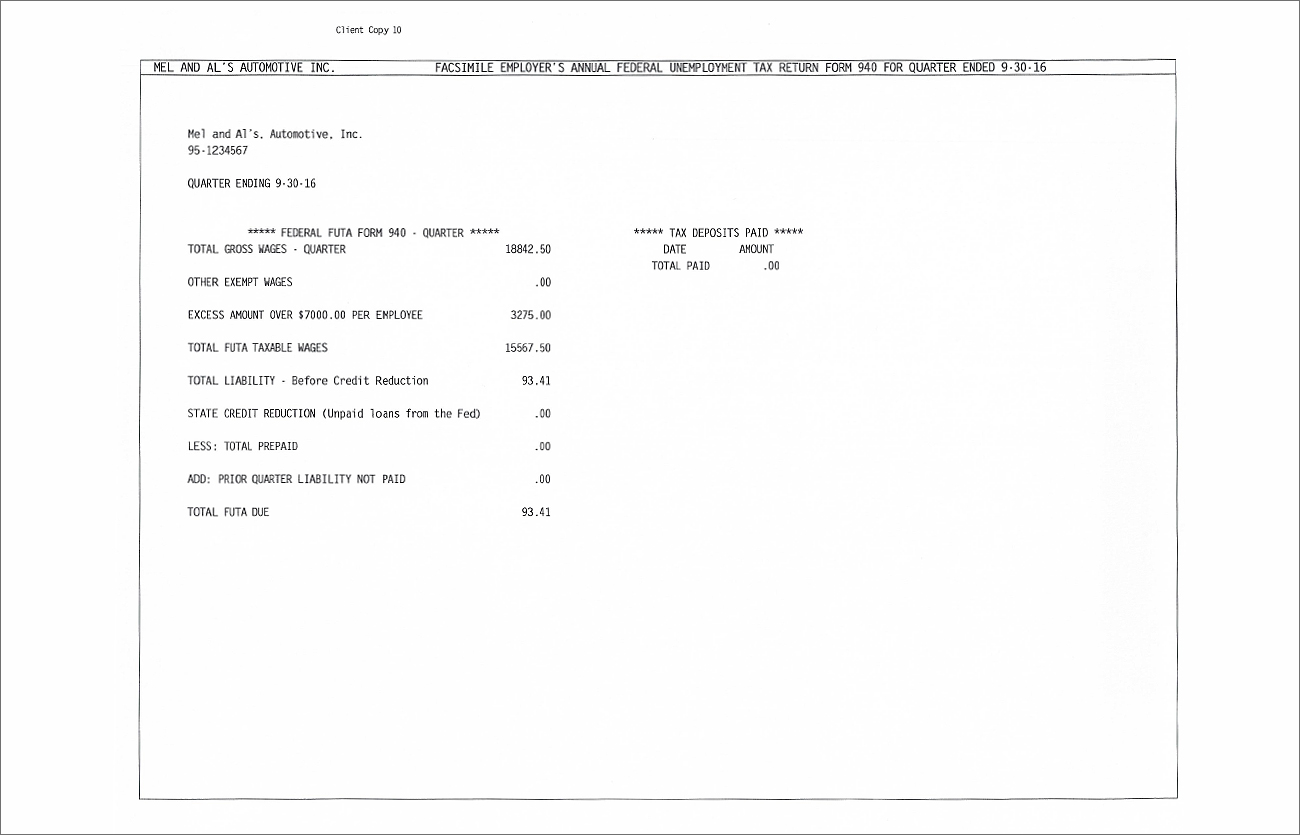

Quarterly Tax Package

Each quarter we prepare the quarterly payroll tax return, applicable state tax return, and at the end of the year the federal unemployment tax return and W2 forms. We charge $25.00 each quarter and 15 cents for each W2. We sign and file all of the documents with the agencies and provide a complete package to the client including copied of the returns, worksheets, employee analysis, etc.

- We sign, file, upload, and provide the package to the client.

- 4th quarter is is included in the $25 fee

- Additional cost is 15 cents for each W2

- Employee Summary

- Federal and State Taxes

- 941 Form and Analysis worksheet

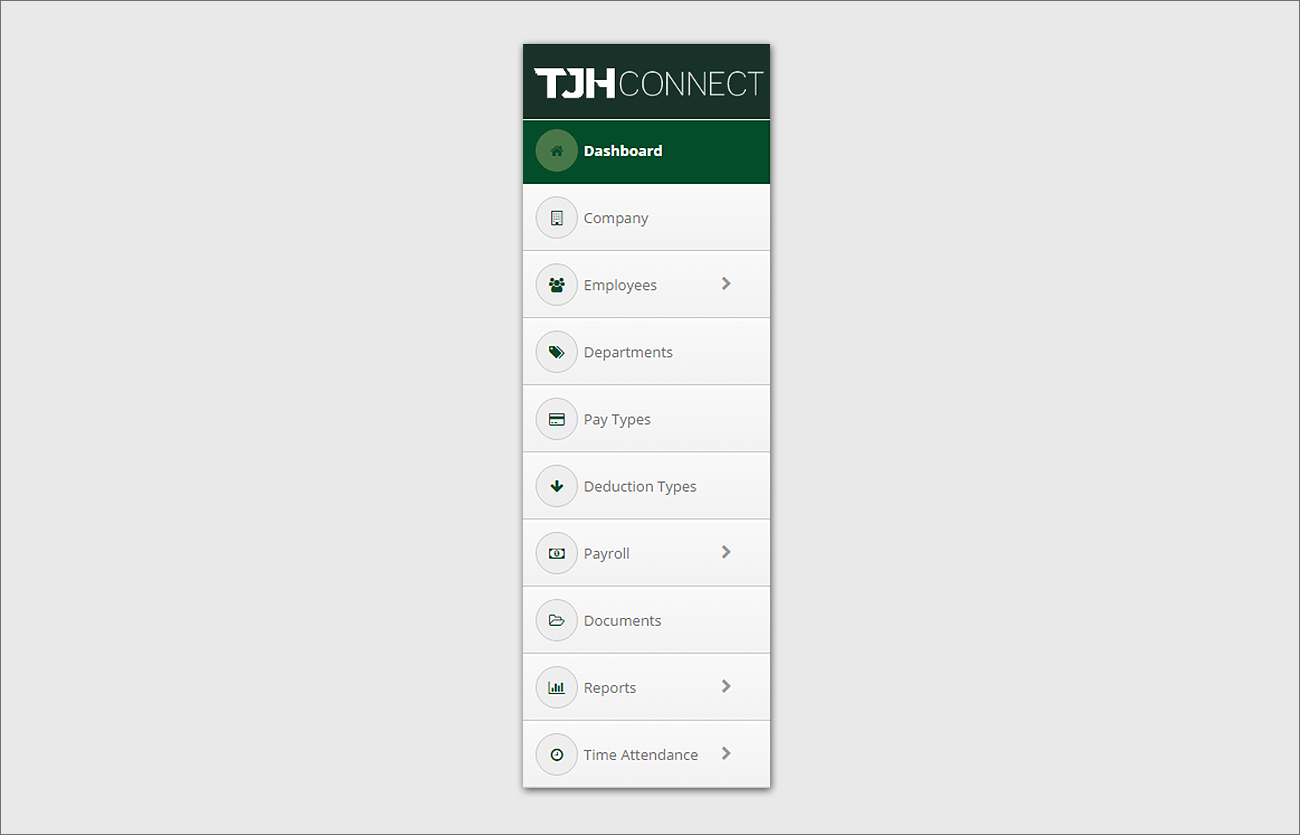

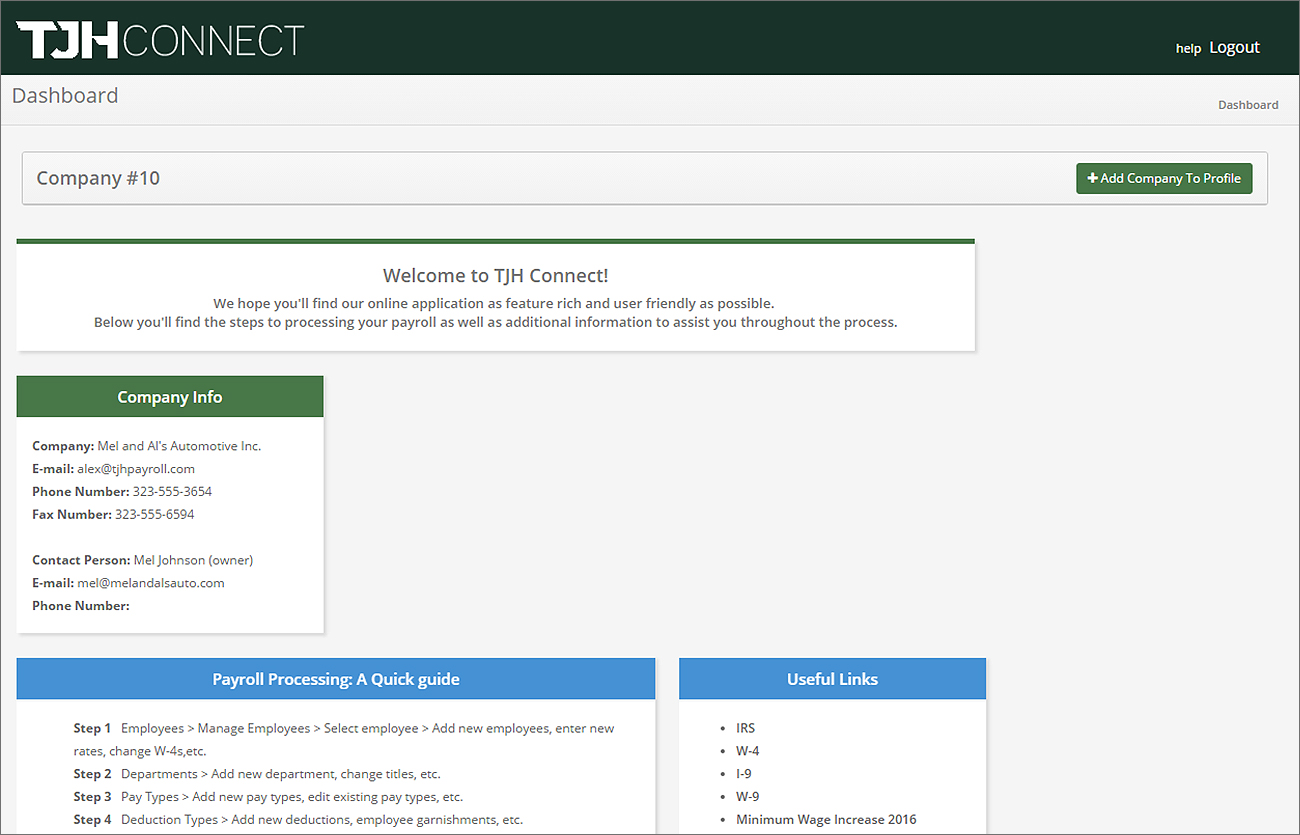

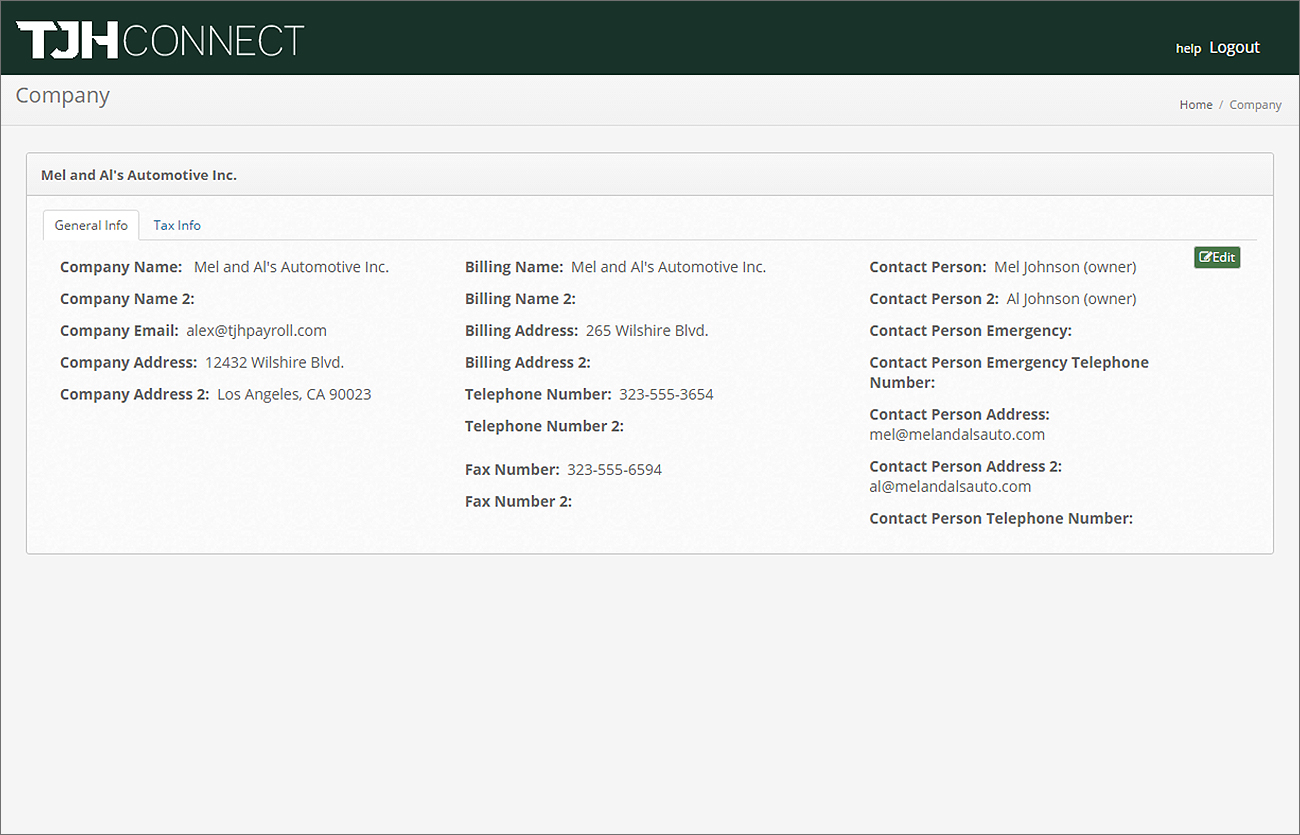

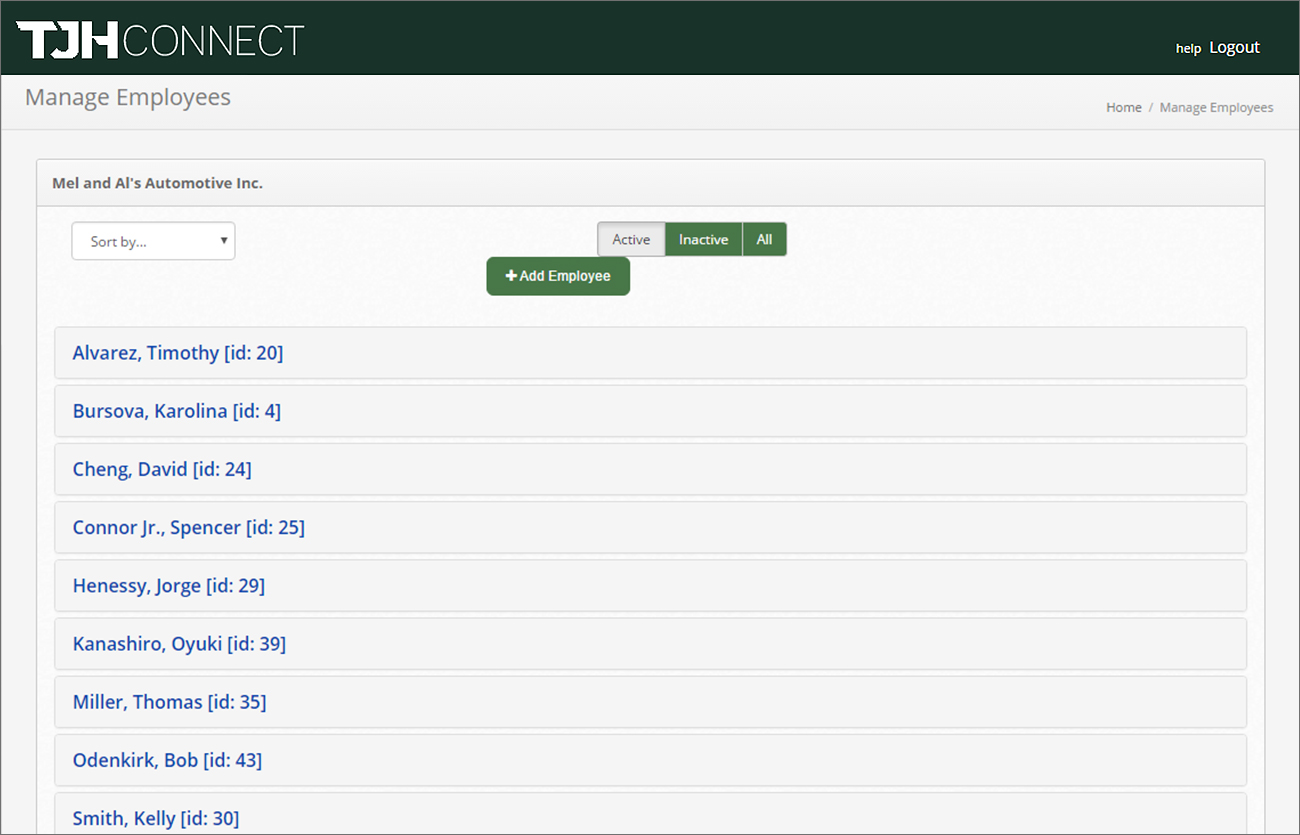

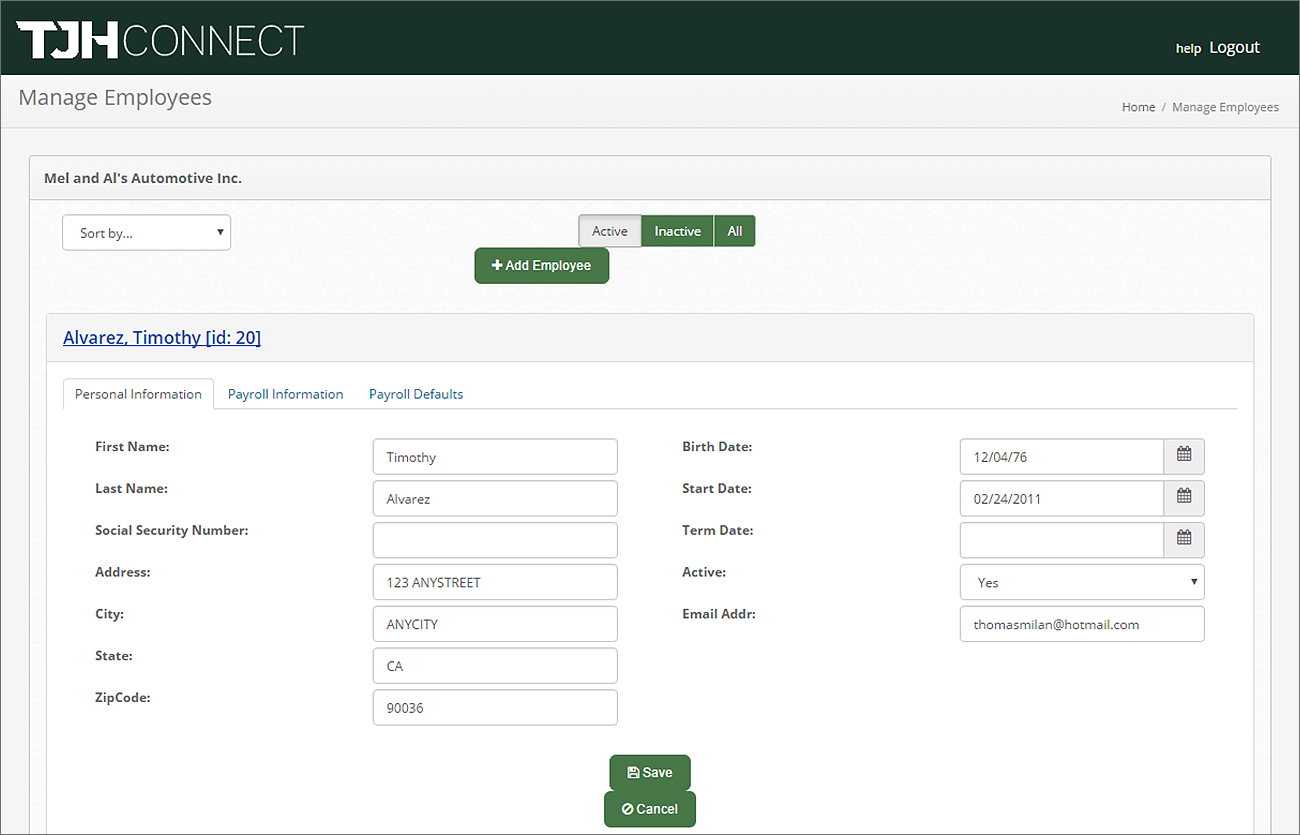

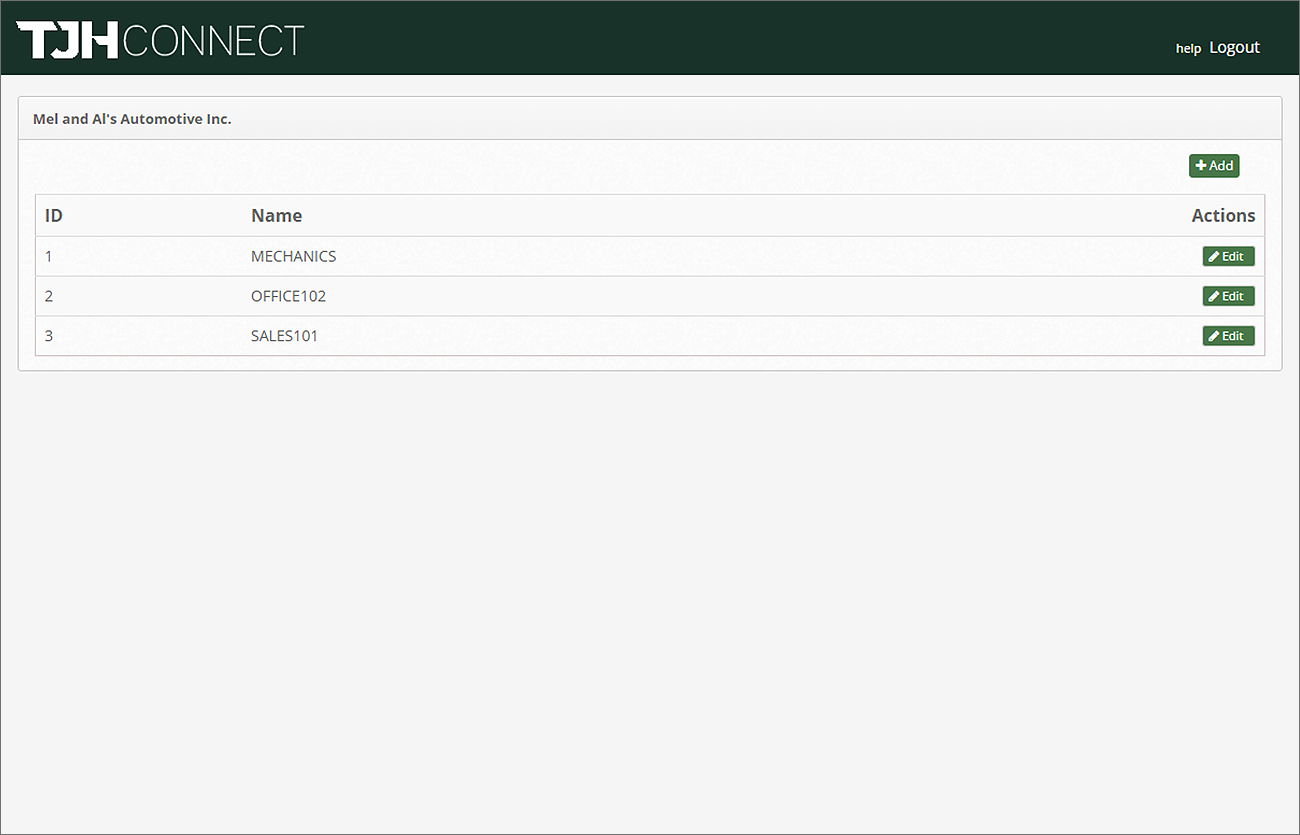

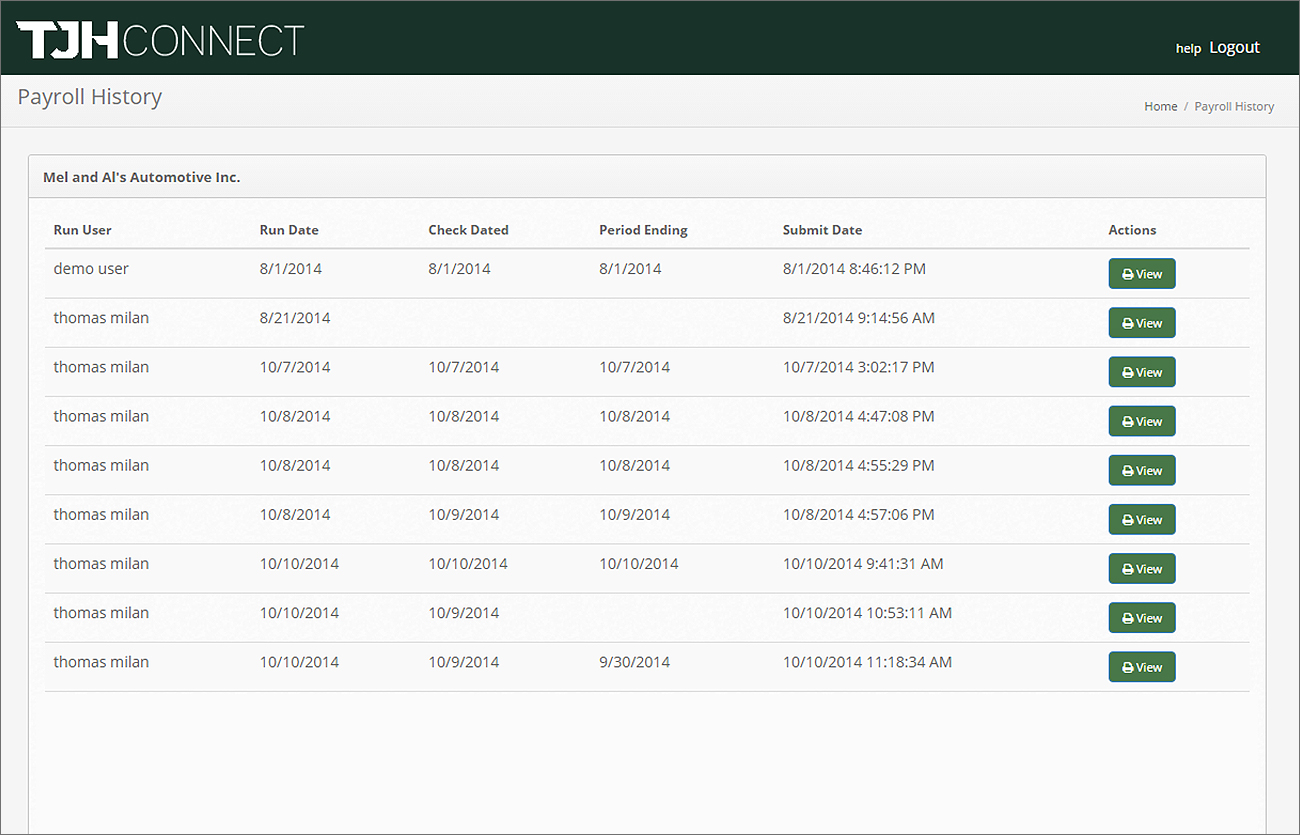

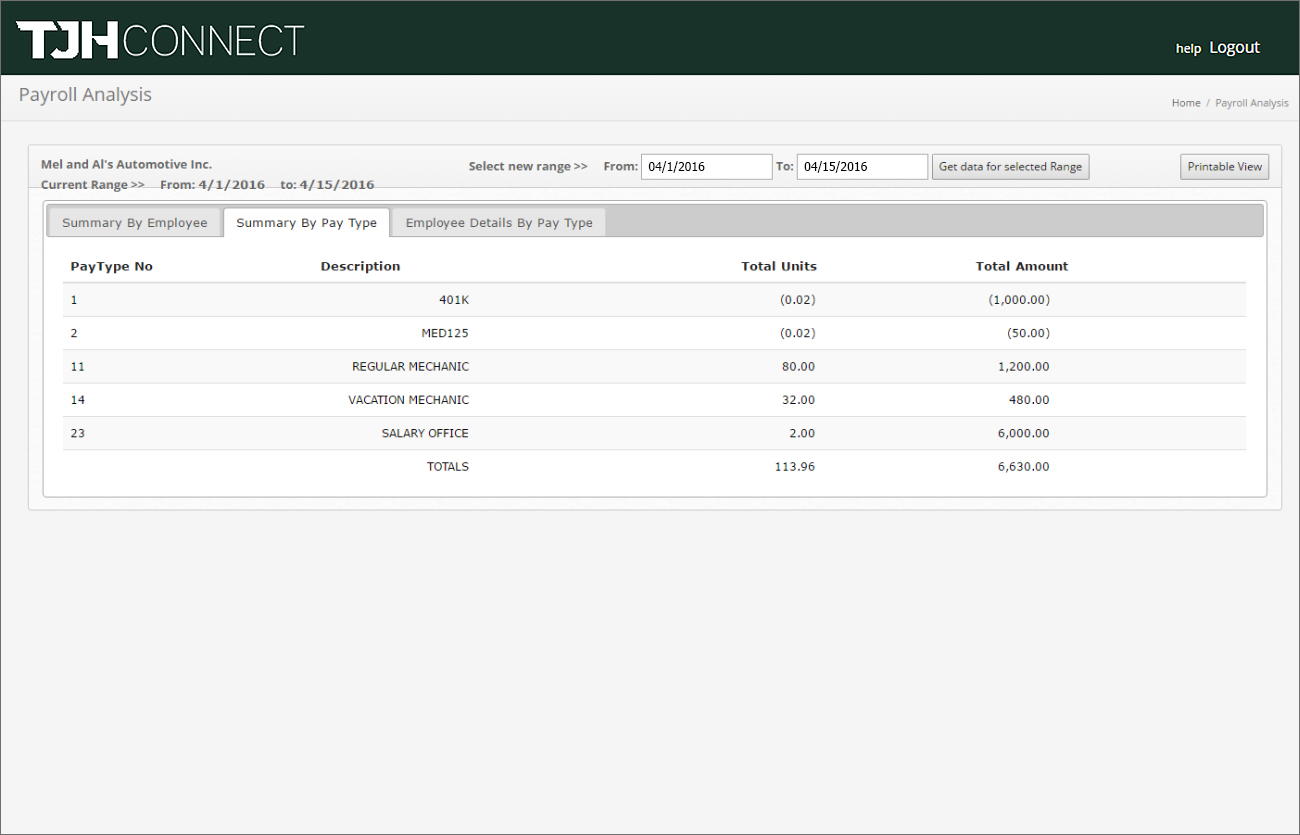

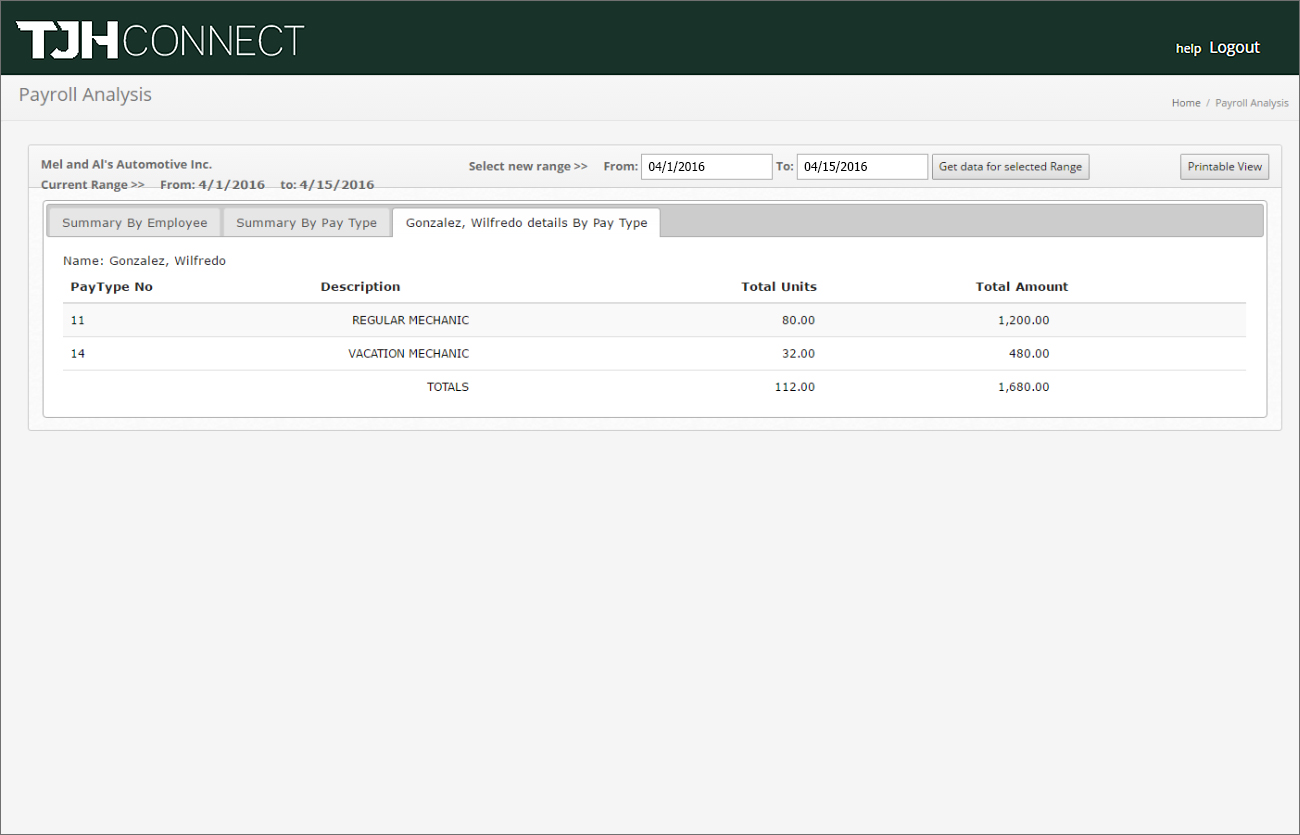

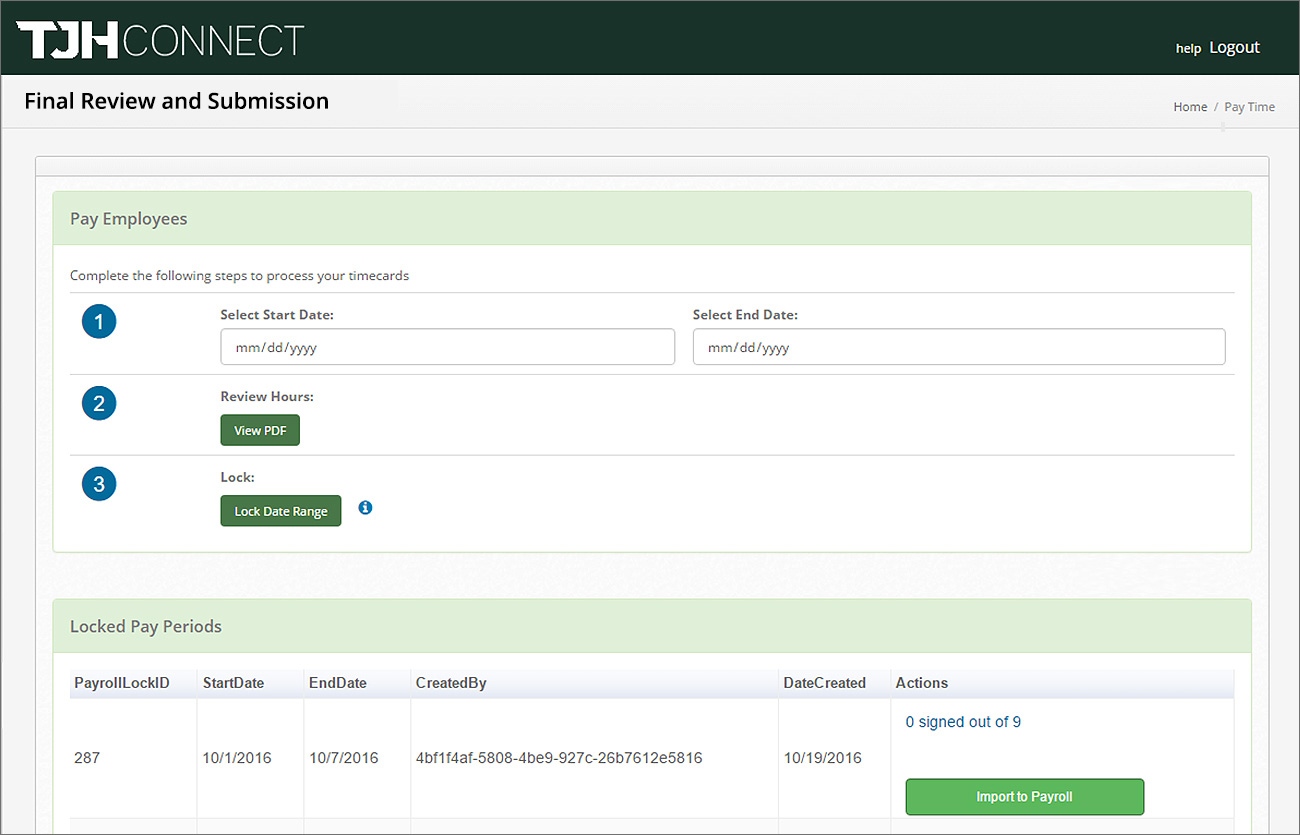

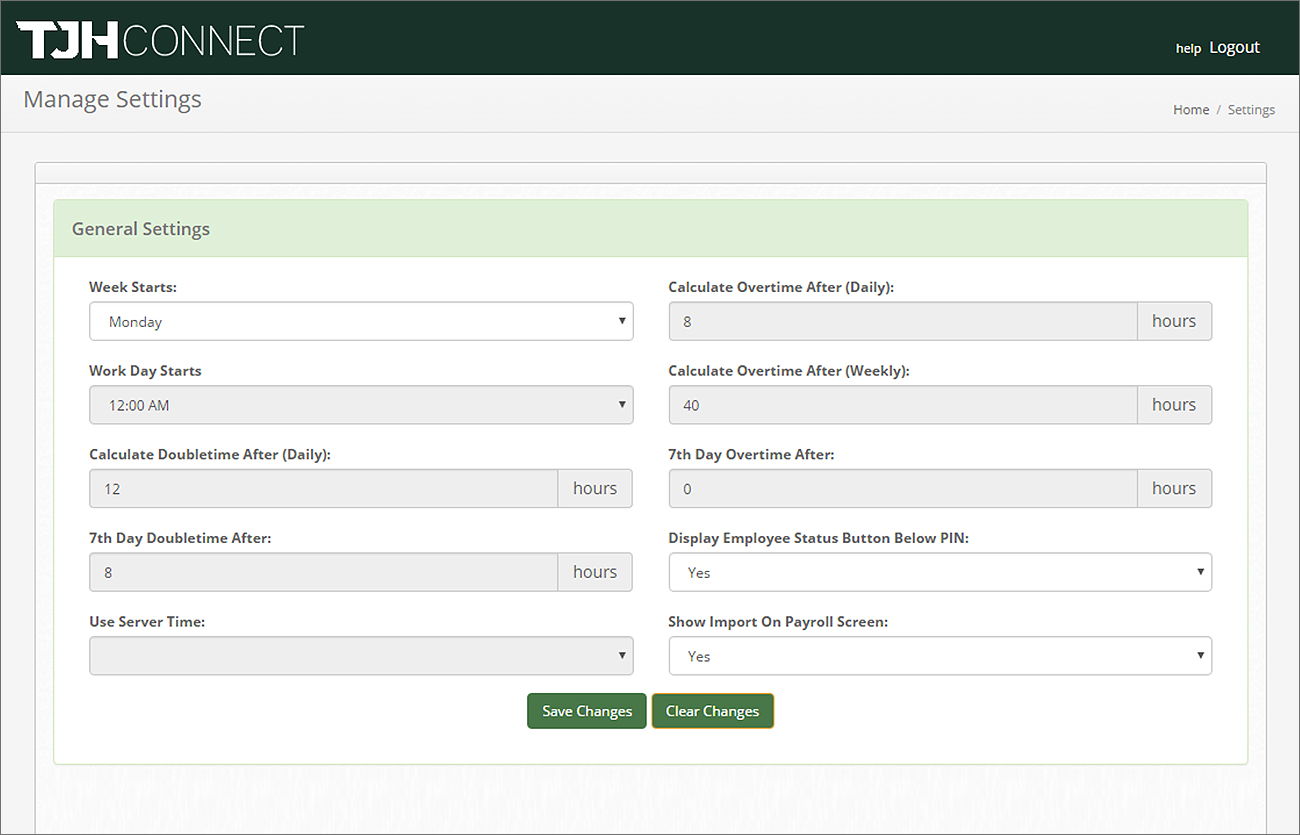

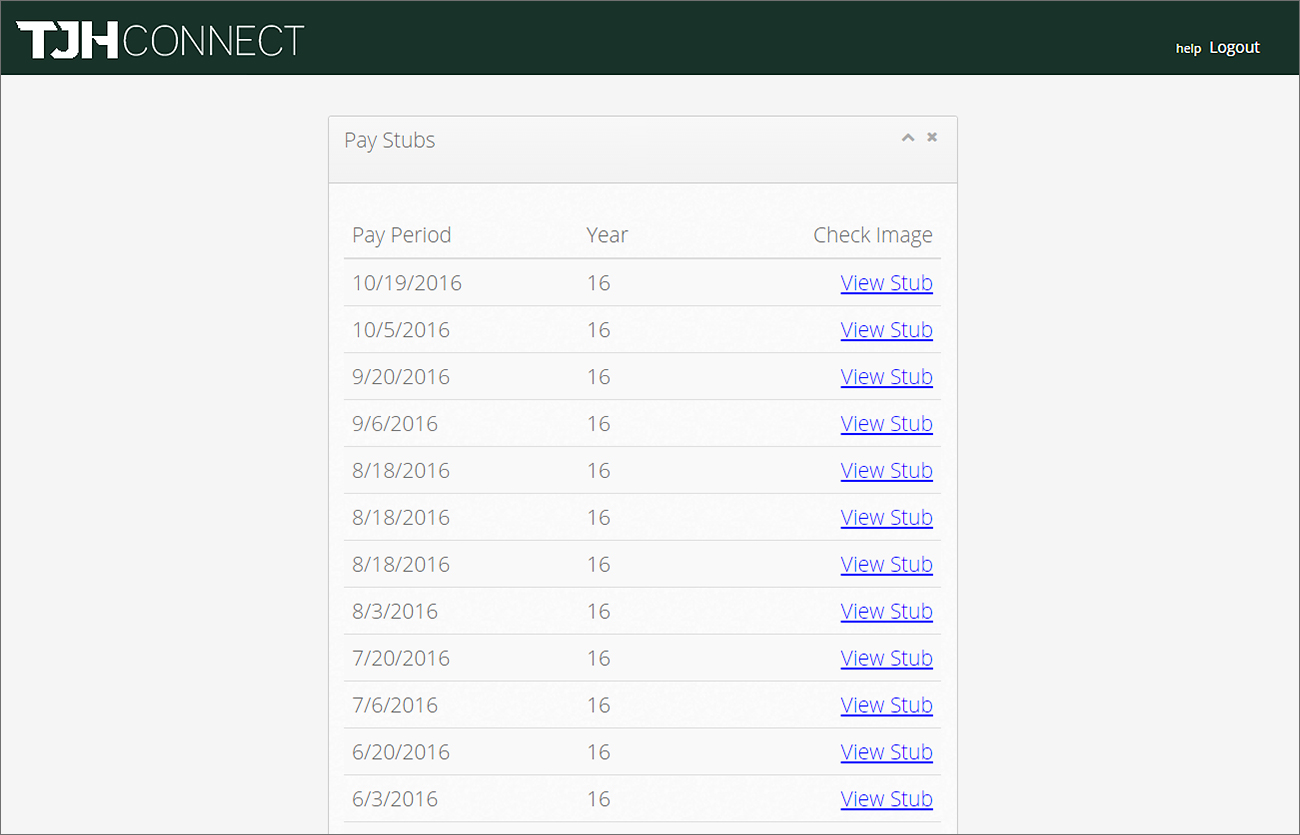

Online Payroll Management (TJH Connect)

- No programs to install. An internet enabled computer is all you’ll need.

- Submit payroll faster

- Once payroll is completed you can immediately access your reports and documents.

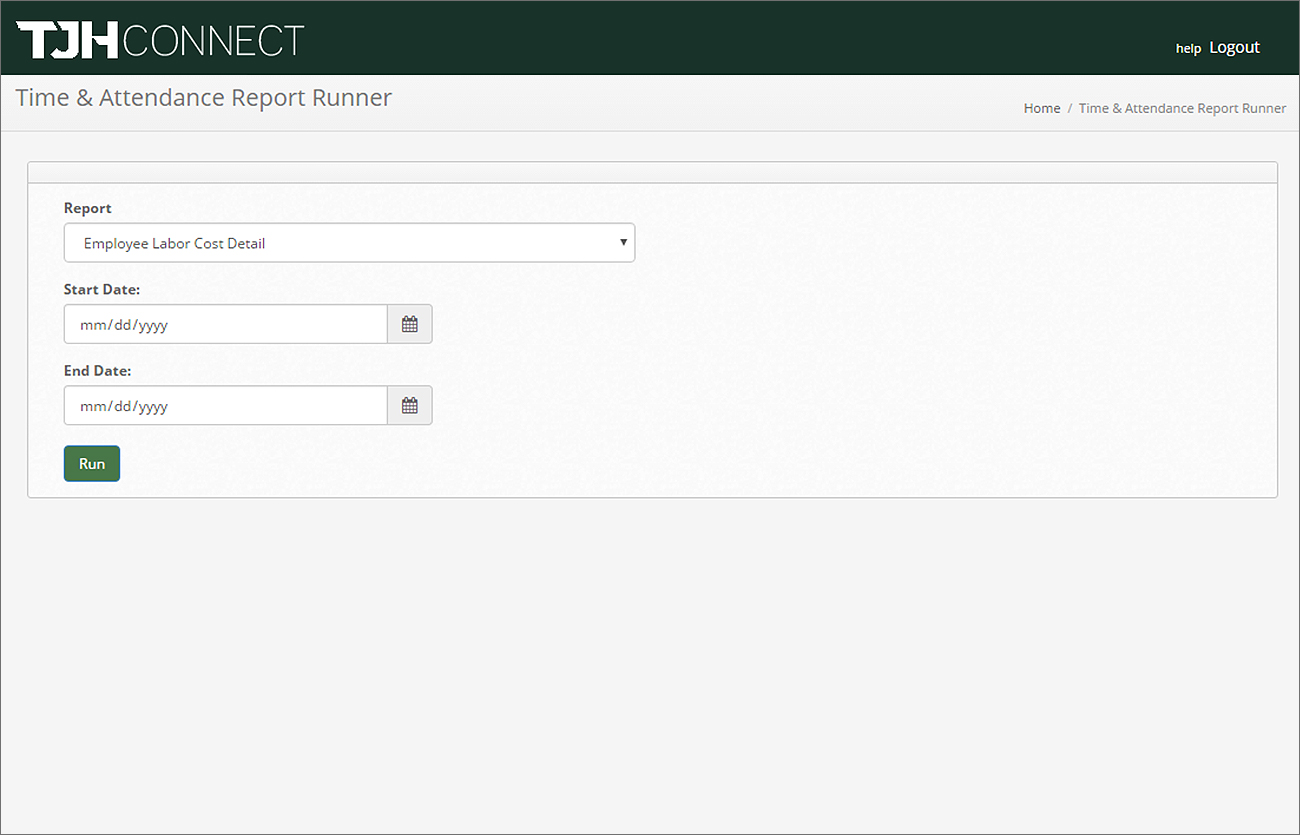

- Ability to run pre-set reports and view them online.

- Ability to do a payroll analysis to see employee earnings through any date range.

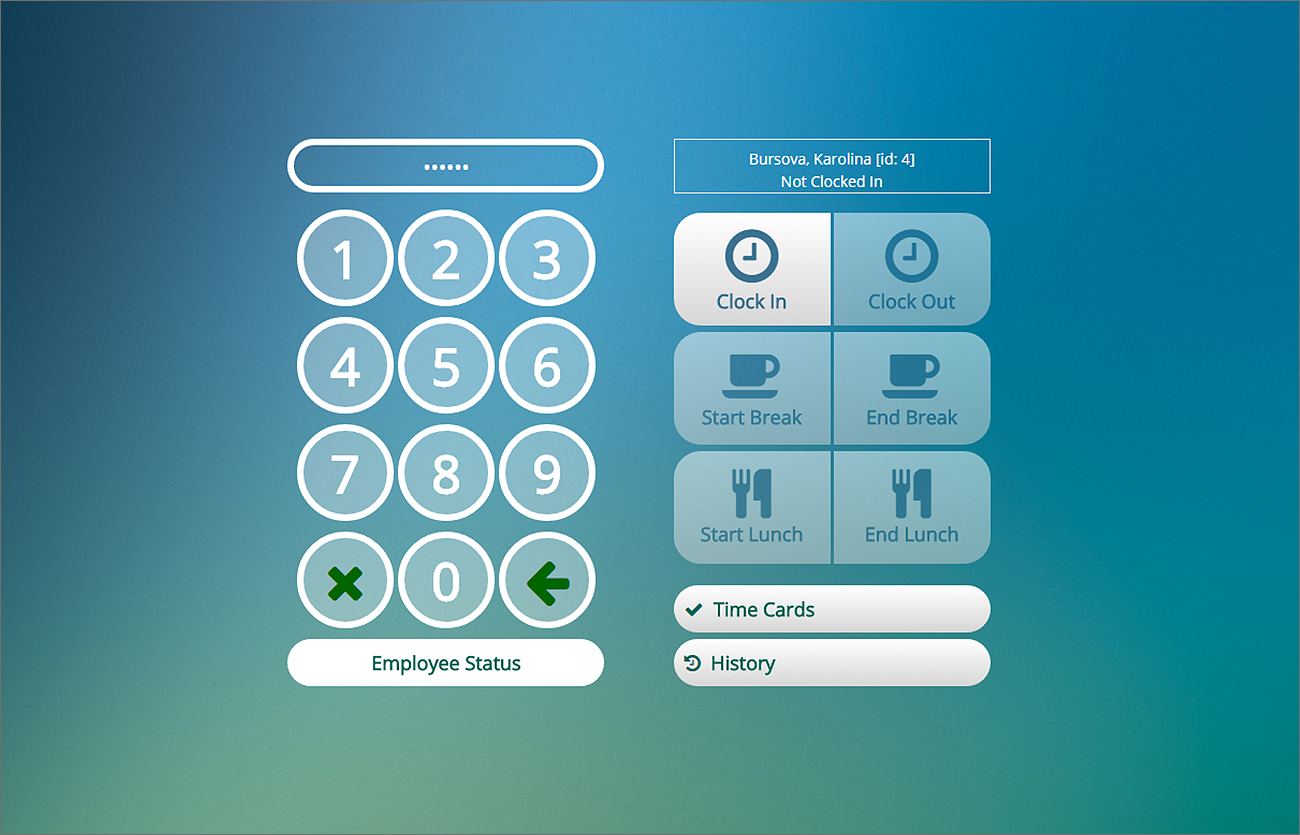

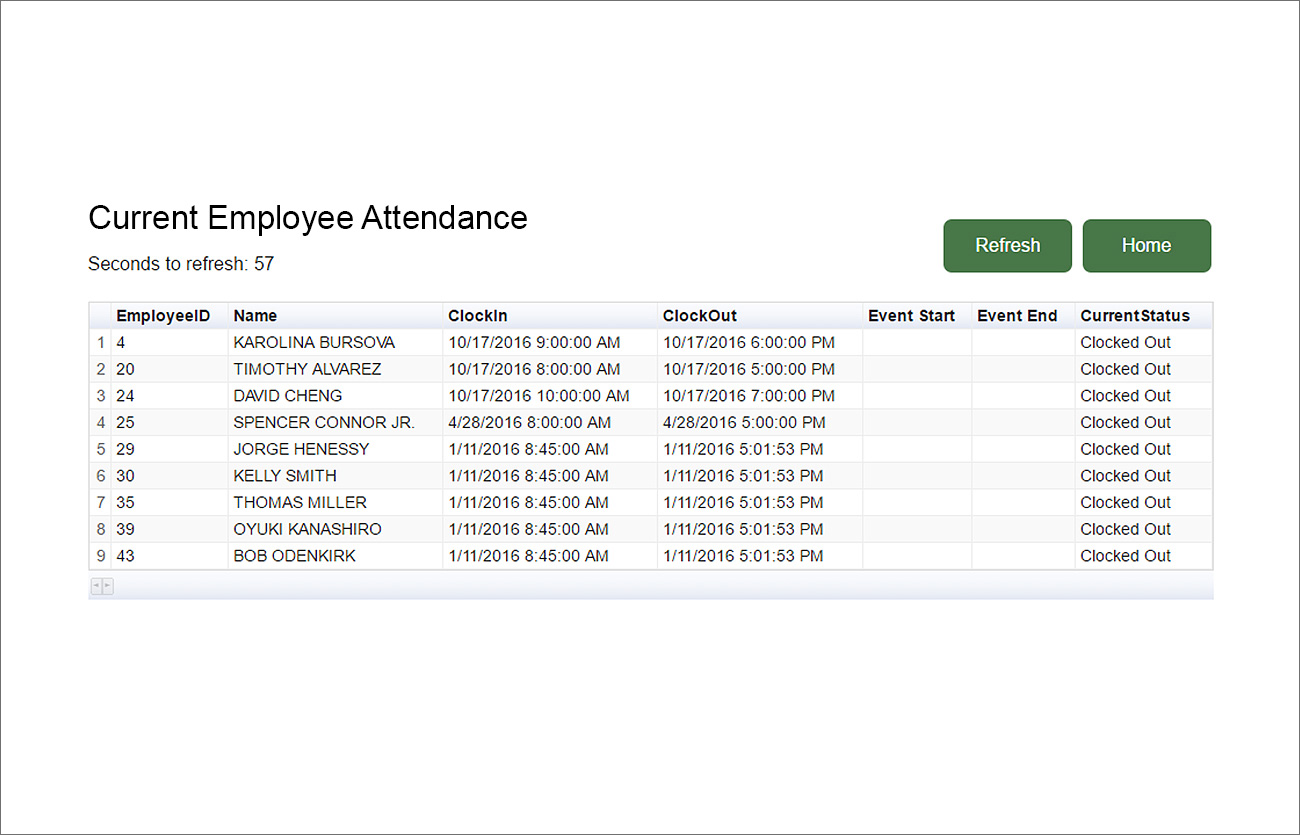

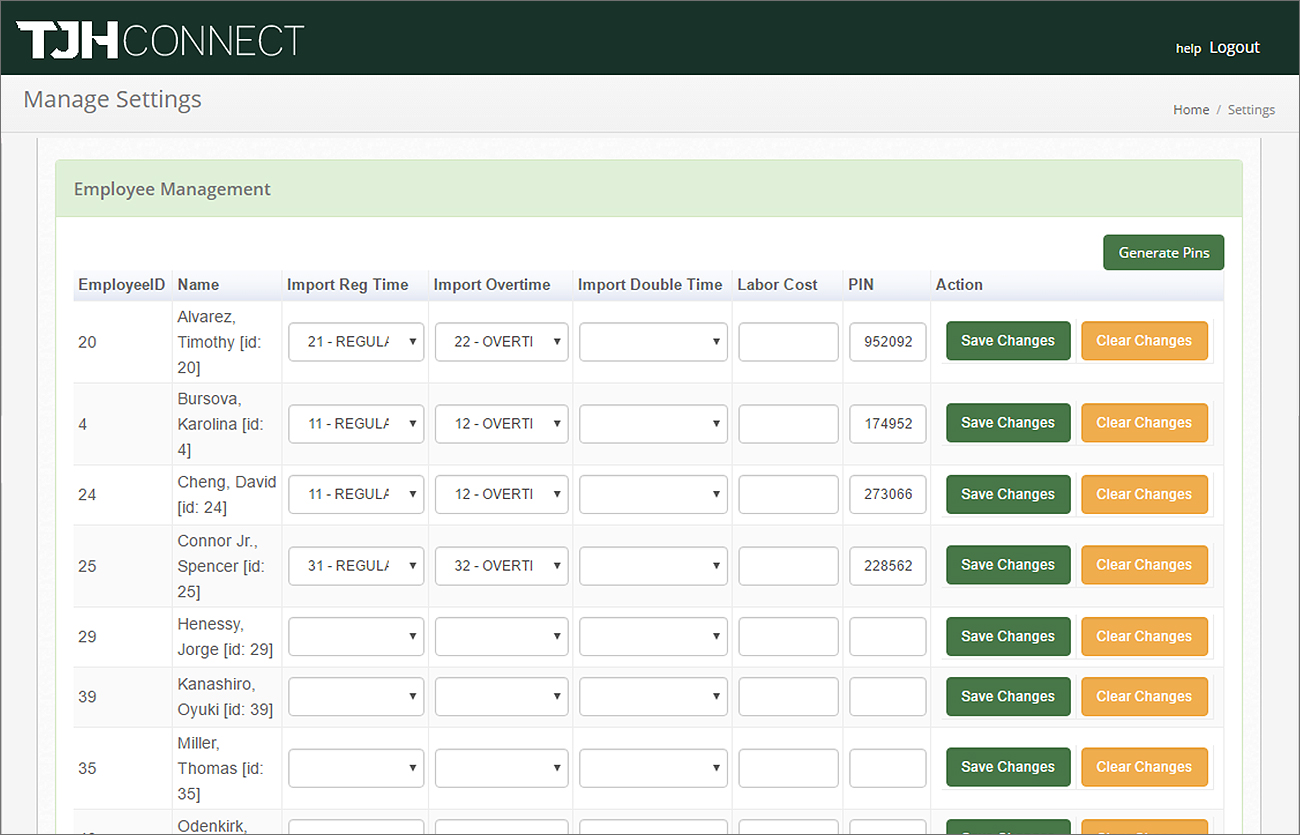

Time and Attendance Lite

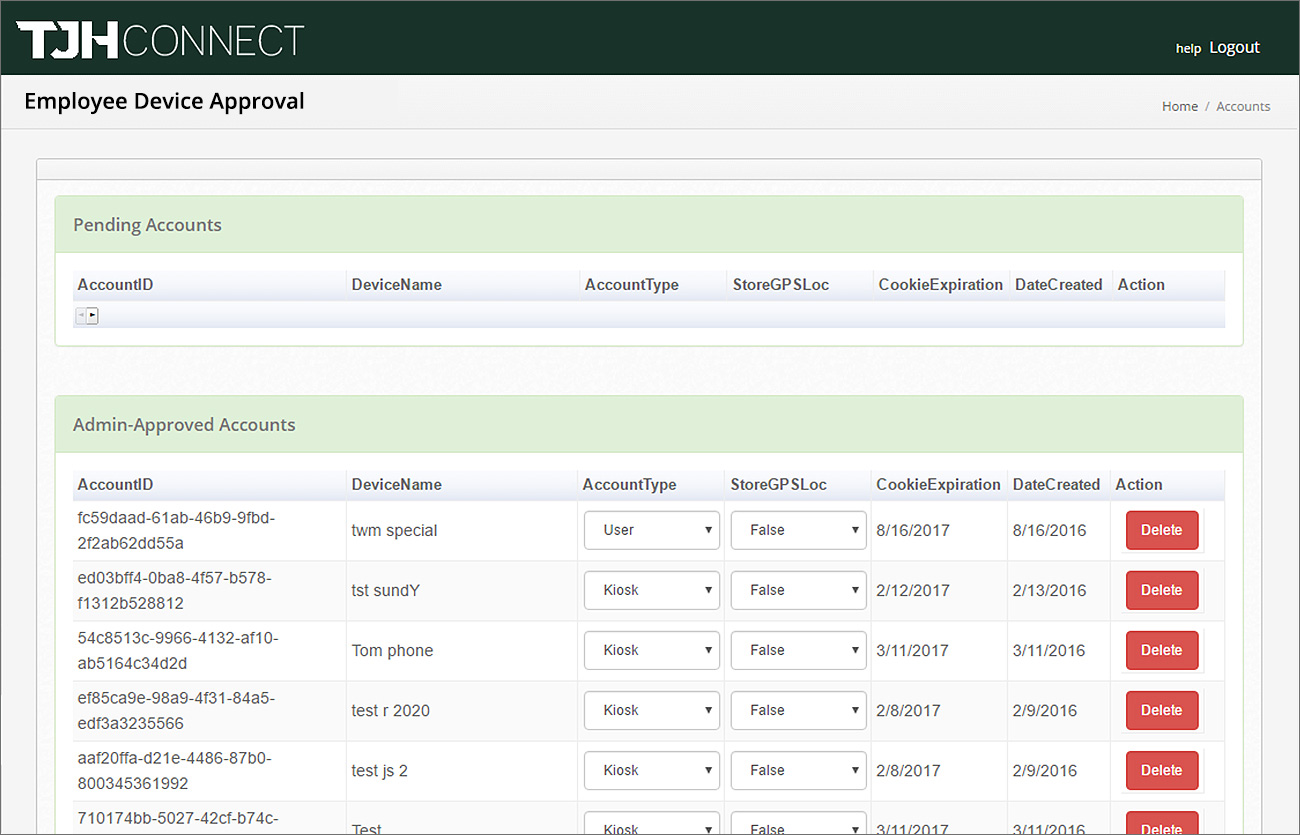

- Simply connect from any internet enabled device, whether it’s a computer, smartphone, or tablet. It can do it all!

- Create as many clock-in stations as you’d like that your employee’s can use with the 6-digit pin you provide them.

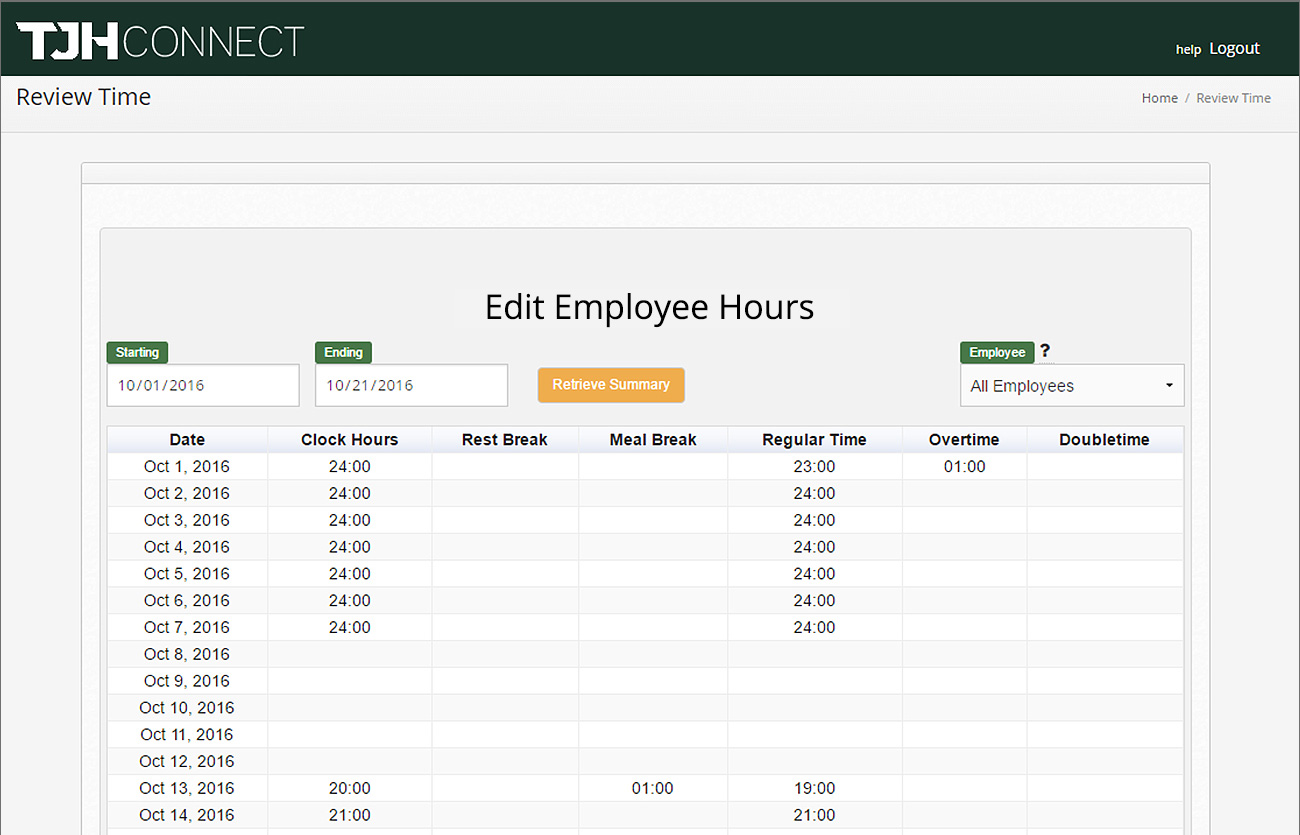

- Easily collect hours for your employees including breaks and lunches.

- Seamlessly upload collected hours to a payroll screen for final editing and submission.

- See the attendance status of any employee, whether they’re clocked in, on a lunch, or just off for the day.

- Review the GPS location of a device when an employee clocks-in or out, allowing you to see when and where they did so.

- Ability to edit employee hours to fix any mistakes that might have occured.

- Employees can monitor their hours to insure they don’t reach overtime.

- Employees can view their timecards and even sign for them.

- Employees have a history of their clock hours that can be viewed from the clock-in station you create.

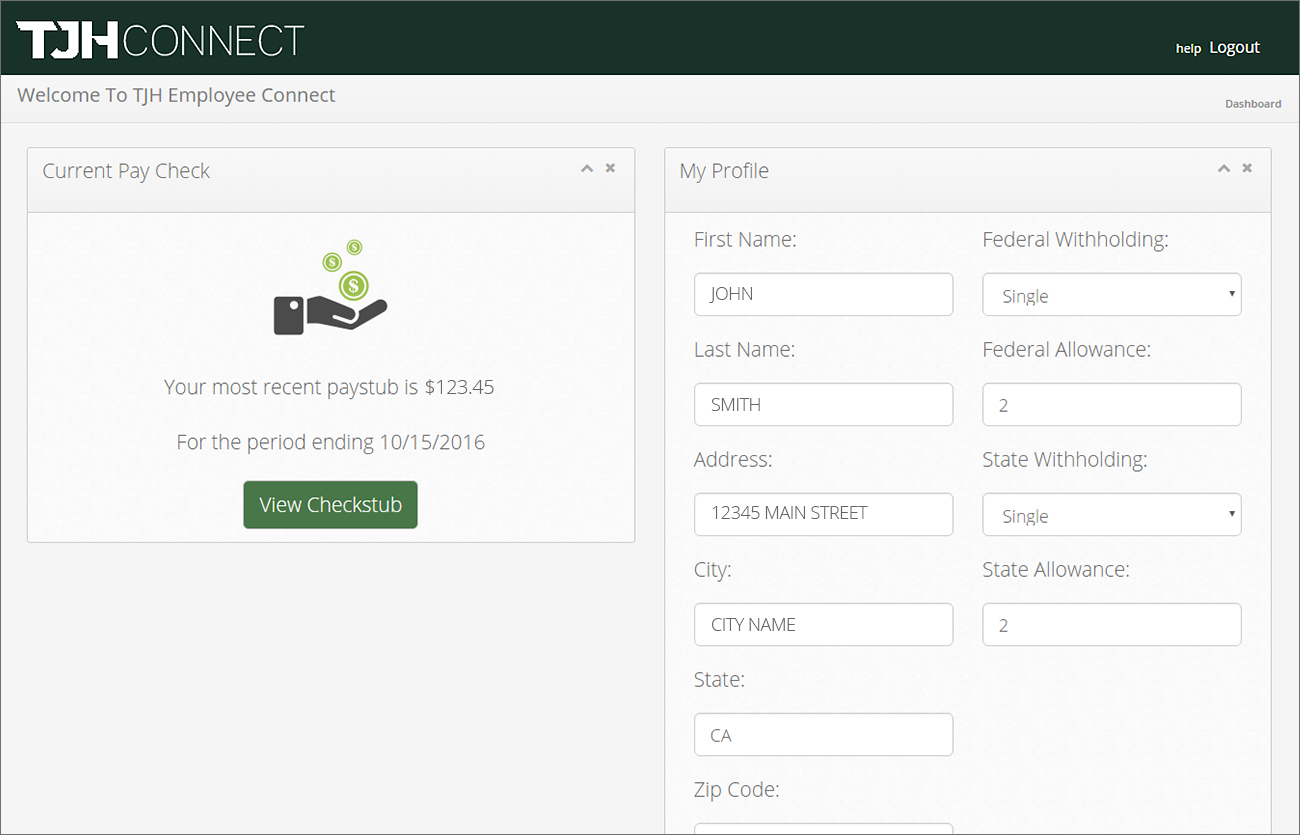

Employee Portal

- Employees are invited to join and given an ID and password to access the employee portal.

- Employees can view the current paystub as well as the prior paystubs.

Join Us Today